Integrate with PayU Hosted Checkout

With the PayU Hosted Checkout integration, the entire payment experience is controlled by PayU. The following sections describe how to use the PayU Hosted Integration to collect payments with various types of offers:

Experience the end-to-end Instant Discount/Cashback or SKU-Based Offer flow and instantly generate the complete code for seamless, zero-coding integration into your website.

General customer journey

-

Customer clicks Pay on your mobile application or website.

-

Customer is redirected to the PayU Hosted Checkout page.

The PayU Hosted Checkout page on Desktop is similar to the following screenshot. In case offer keys have been passed by the merchant, the same would be filtered and displayed to the customer.

-

Customer is shown the applicable offers on the checkout page for that transaction.

-

Customer will have an option to apply the offer. If the offer is applicable on a specific payment option, the customer will be redirected to the specific payment option.

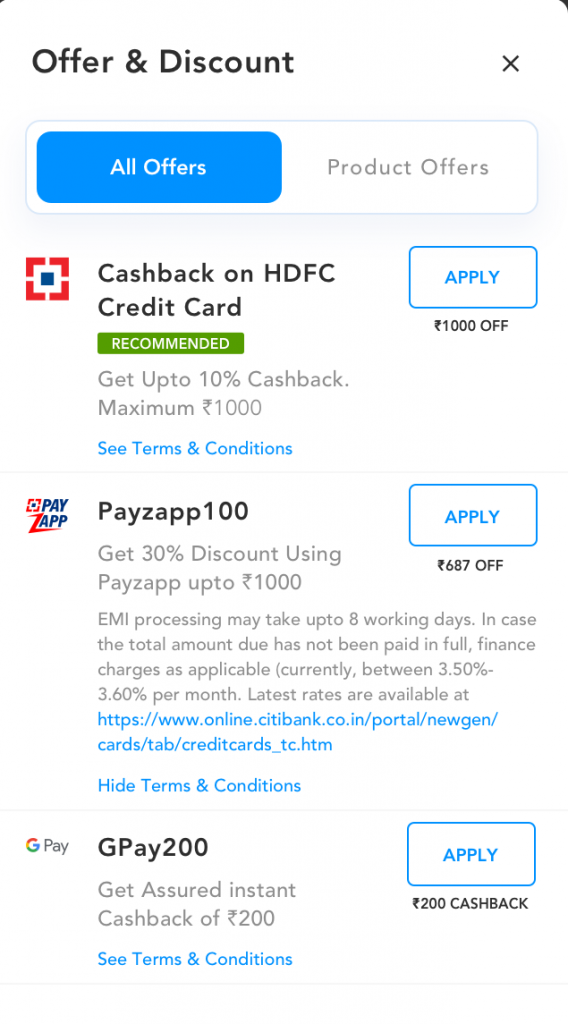

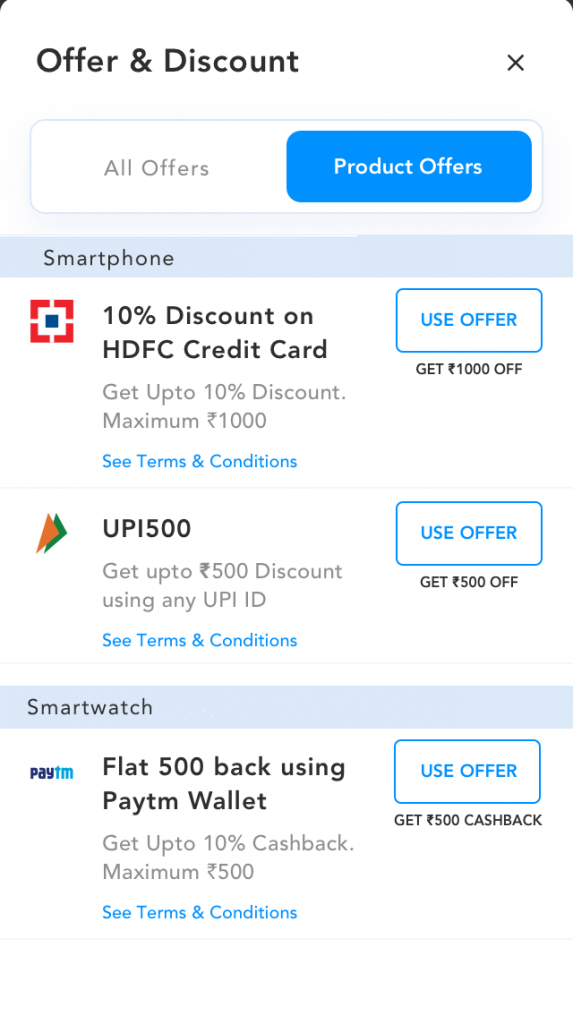

The PayU Hosted Checkout page for specify payment option on Mobile.

- Alternatively, the customer can choose the payment option. If only an offer is applicable for that payment option, the offer will be automatically applied.

- For Instant Discount, the amount is reduced after the offer is applied, whereas, in the case of cashback, the amount will not be reduced after the offer is applied.

- Customer completes the 2FA payment on the adjusted amount.

- Customer is redirected back to the merchant mobile application or website.

Instant Discount or Cashback

With the PayU Hosted Checkout integration, the entire payment experience is controlled by PayU. This section describes how to use the PayU Hosted Integration to collect payments with offers.

Customer journey on PayU Hosted Checkout

-

Customer clicks Pay on your mobile application or website.

-

Customer is redirected to the PayU Hosted Checkout page.

The PayU Hosted Checkout page on Desktop is similar to the following screenshot. In case offer keys have been passed by the merchant, the same would be filtered and displayed to the customer.

The PayU Hosted Checkout page on Mobile

- Customer is shown the applicable offers on the checkout page for that transaction.

- Customer will have the option to apply the offer. If the offer is applicable to a specific payment option, the customer will be redirected to the specific payment option.

The PayU Hosted Checkout page for specific payment option on Mobile is similar to the following screenshot:

- Alternatively, the customer can choose the payment option. If only an offer is applicable for that payment option, the offer will be automatically applied.

- For Instant Discount, the amount is reduced after the offer is applied, whereas, in the case of cashback, the amount will not be reduced after the offer is applied.

- Customer completes the 2FA payment on the adjusted amount.

- Customer is redirected back to the merchant's mobile application or website.

Integration steps

To integrate offers using PayU Hosted Checkout integration:

Reference: For the PayU Hosted Checkout flow, refer to PayU Hosted Checkout.

-

Make the payment request to PayU:

You need to send an additional parameter (user token), api_version as 14, and hash as described in the following table. This user token would be used to identify the customer for applying velocity rules.

Request parameters

Parameter | Description | Example |

|---|---|---|

api_version

| The API version of the _payment API must be specified as 14. | 14 |

user_token

| The use for this param is to allow the offer engine to apply velocity rules at a user level.

| |

hash for UPI, NB, Wallet | It is used to avoid the possibility of transaction tampering.

|

Sample request

curl --location 'https://test.payu.in/_payment' \

--header 'Content-Type: application/x-www-form-urlencoded' \

--header 'Cookie: PHPSESSID=nbn8otc350bsv6u5fqvhcbo73b; PHPSESSID=63a0499eaf13e' \

--data-urlencode 'key=JF****g' \

--data-urlencode 'txnid=jYhbOYH9o4' \

--data-urlencode 'amount=10' \

--data-urlencode 'productinfo=Product_info' \

--data-urlencode 'firstname=Ashish' \

--data-urlencode 'lastname=Test' \

--data-urlencode '[email protected]' \

--data-urlencode 'phone=9876543210' \

--data-urlencode 'furl=http://pp30admin.payu.in/test_response' \

--data-urlencode 'surl=http://pp30admin.payu.in/test_response' \

--data-urlencode 'hash=e5b286a9c8545038de9d4e4ee4d8a2fd02e821015aff7e0323807ba174997d8643f9aa174981385e3e4dfe60b918650806ccb97b3e8e3471e1985ecadefd0184' \

--data-urlencode 'api_version=14' \

--data-urlencode 'user_token=8789'

// Using Fetch API with URLSearchParams

const url = "https://test.payu.in/_payment";

// Define form data

const formData = new URLSearchParams({

'key': 'JF****g',

'txnid': 'jYhbOYH9o4',

'amount': '10',

'productinfo': 'Product_info',

'firstname': 'Ashish',

'lastname': 'Test',

'email': '[email protected]',

'phone': '9876543210',

'furl': 'http://pp30admin.payu.in/test_response',

'surl': 'http://pp30admin.payu.in/test_response',

'hash': 'e5b286a9c8545038de9d4e4ee4d8a2fd02e821015aff7e0323807ba174997d8643f9aa174981385e3e4dfe60b918650806ccb97b3e8e3471e1985ecadefd0184',

'api_version': '14',

'user_token': '8789'

});

// Make the request

fetch(url, {

method: 'POST',

headers: {

'Content-Type': 'application/x-www-form-urlencoded',

'Cookie': 'PHPSESSID=nbn8otc350bsv6u5fqvhcbo73b; PHPSESSID=63a0499eaf13e'

},

body: formData

})

.then(response => {

console.log('Status:', response.status);

return response.text();

})

.then(data => {

console.log('Response:', data);

})

.catch(error => {

console.error('Error:', error);

});

import requests

# Define the URL

url = "https://test.payu.in/_payment"

# Define headers

headers = {

'Content-Type': 'application/x-www-form-urlencoded',

'Cookie': 'PHPSESSID=nbn8otc350bsv6u5fqvhcbo73b; PHPSESSID=63a0499eaf13e'

}

# Define form data

data = {

'key': 'JF****g',

'txnid': 'jYhbOYH9o4',

'amount': '10',

'productinfo': 'Product_info',

'firstname': 'Ashish',

'lastname': 'Test',

'email': '[email protected]',

'phone': '9876543210',

'furl': 'http://pp30admin.payu.in/test_response',

'surl': 'http://pp30admin.payu.in/test_response',

'hash': 'e5b286a9c8545038de9d4e4ee4d8a2fd02e821015aff7e0323807ba174997d8643f9aa174981385e3e4dfe60b918650806ccb97b3e8e3471e1985ecadefd0184',

'api_version': '14',

'user_token': '8789'

}

# Make the request

try:

response = requests.post(url, headers=headers, data=data)

print("Status Code:", response.status_code)

print("Response:", response.text)

except requests.exceptions.RequestException as e:

print("Error:", e)

import java.io.*;

import java.net.HttpURLConnection;

import java.net.URL;

import java.net.URLEncoder;

import java.nio.charset.StandardCharsets;

import java.util.HashMap;

import java.util.Map;

import java.util.StringJoiner;

public class PayUSimpleRequest {

public static void main(String[] args) throws IOException {

String url = "https://test.payu.in/_payment";

// Prepare form data

Map<String, String> parameters = new HashMap<>();

parameters.put("key", "JF****g");

parameters.put("txnid", "jYhbOYH9o4");

parameters.put("amount", "10");

parameters.put("productinfo", "Product_info");

parameters.put("firstname", "Ashish");

parameters.put("lastname", "Test");

parameters.put("email", "[email protected]");

parameters.put("phone", "9876543210");

parameters.put("furl", "http://pp30admin.payu.in/test_response");

parameters.put("surl", "http://pp30admin.payu.in/test_response");

parameters.put("hash", "e5b286a9c8545038de9d4e4ee4d8a2fd02e821015aff7e0323807ba174997d8643f9aa174981385e3e4dfe60b918650806ccb97b3e8e3471e1985ecadefd0184");

parameters.put("api_version", "14");

parameters.put("user_token", "8789");

// Build URL-encoded string

StringJoiner sj = new StringJoiner("&");

for (Map.Entry<String, String> entry : parameters.entrySet()) {

sj.add(URLEncoder.encode(entry.getKey(), StandardCharsets.UTF_8) + "=" +

URLEncoder.encode(entry.getValue(), StandardCharsets.UTF_8));

}

byte[] postData = sj.toString().getBytes(StandardCharsets.UTF_8);

// Create connection

URL obj = new URL(url);

HttpURLConnection connection = (HttpURLConnection) obj.openConnection();

// Set request method and headers

connection.setRequestMethod("POST");

connection.setRequestProperty("Content-Type", "application/x-www-form-urlencoded");

connection.setRequestProperty("Cookie", "PHPSESSID=nbn8otc350bsv6u5fqvhcbo73b; PHPSESSID=63a0499eaf13e");

connection.setRequestProperty("Content-Length", String.valueOf(postData.length));

connection.setDoOutput(true);

// Send request

try (DataOutputStream wr = new DataOutputStream(connection.getOutputStream())) {

wr.write(postData);

}

// Read response

int responseCode = connection.getResponseCode();

InputStream inputStream = responseCode >= 200 && responseCode < 300

? connection.getInputStream()

: connection.getErrorStream();

BufferedReader in = new BufferedReader(new InputStreamReader(inputStream));

String inputLine;

StringBuilder response = new StringBuilder();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine).append("\n");

}

in.close();

System.out.println("Response Code: " + responseCode);

System.out.println("Response: " + response.toString());

}

}

<?php

// Define the URL

$url = "https://test.payu.in/_payment";

// Prepare form data

$postData = array(

'key' => 'JF****g',

'txnid' => 'jYhbOYH9o4',

'amount' => '10',

'productinfo' => 'Product_info',

'firstname' => 'Ashish',

'lastname' => 'Test',

'email' => '[email protected]',

'phone' => '9876543210',

'furl' => 'http://pp30admin.payu.in/test_response',

'surl' => 'http://pp30admin.payu.in/test_response',

'hash' => 'e5b286a9c8545038de9d4e4ee4d8a2fd02e821015aff7e0323807ba174997d8643f9aa174981385e3e4dfe60b918650806ccb97b3e8e3471e1985ecadefd0184',

'api_version' => '14',

'user_token' => '8789'

);

// Initialize cURL

$ch = curl_init();

// Set cURL options

curl_setopt($ch, CURLOPT_URL, $url);

curl_setopt($ch, CURLOPT_POST, true);

curl_setopt($ch, CURLOPT_POSTFIELDS, http_build_query($postData));

curl_setopt($ch, CURLOPT_RETURNTRANSFER, true);

curl_setopt($ch, CURLOPT_FOLLOWLOCATION, true);

curl_setopt($ch, CURLOPT_SSL_VERIFYPEER, true);

curl_setopt($ch, CURLOPT_HTTPHEADER, array(

'Content-Type: application/x-www-form-urlencoded',

'Cookie: PHPSESSID=nbn8otc350bsv6u5fqvhcbo73b; PHPSESSID=63a0499eaf13e'

));

// Execute request

$response = curl_exec($ch);

$httpCode = curl_getinfo($ch, CURLINFO_HTTP_CODE);

// Check for errors

if (curl_errno($ch)) {

echo 'cURL error: ' . curl_error($ch) . "\n";

} else {

echo "HTTP Code: " . $httpCode . "\n";

echo "Response: " . $response . "\n";

}

// Close cURL

curl_close($ch);

?>

using System;

using System.Collections.Generic;

using System.Net.Http;

using System.Threading.Tasks;

class Program

{

static async Task Main(string[] args)

{

var client = new HttpClient();

var url = "https://test.payu.in/_payment";

// Prepare form data

var formData = new List<KeyValuePair<string, string>>

{

new KeyValuePair<string, string>("key", "JF****g"),

new KeyValuePair<string, string>("txnid", "jYhbOYH9o4"),

new KeyValuePair<string, string>("amount", "10"),

new KeyValuePair<string, string>("productinfo", "Product_info"),

new KeyValuePair<string, string>("firstname", "Ashish"),

new KeyValuePair<string, string>("lastname", "Test"),

new KeyValuePair<string, string>("email", "[email protected]"),

new KeyValuePair<string, string>("phone", "9876543210"),

new KeyValuePair<string, string>("furl", "http://pp30admin.payu.in/test_response"),

new KeyValuePair<string, string>("surl", "http://pp30admin.payu.in/test_response"),

new KeyValuePair<string, string>("hash", "e5b286a9c8545038de9d4e4ee4d8a2fd02e821015aff7e0323807ba174997d8643f9aa174981385e3e4dfe60b918650806ccb97b3e8e3471e1985ecadefd0184"),

new KeyValuePair<string, string>("api_version", "14"),

new KeyValuePair<string, string>("user_token", "8789")

};

var formContent = new FormUrlEncodedContent(formData);

// Set headers

client.DefaultRequestHeaders.Add("Cookie", "PHPSESSID=nbn8otc350bsv6u5fqvhcbo73b; PHPSESSID=63a0499eaf13e");

try

{

var response = await client.PostAsync(url, formContent);

var responseContent = await response.Content.ReadAsStringAsync();

Console.WriteLine($"Status Code: {response.StatusCode}");

Console.WriteLine($"Response: {responseContent}");

}

catch (Exception ex)

{

Console.WriteLine($"Error: {ex.Message}");

}

finally

{

client.Dispose();

}

}

}

-

Check the response from PayU.

You need to understand the following parameters to handle the payment response as the net amount debit may be different from the amount sent by you in the request.

Response parameters

Parameter | Description | Example |

|---|---|---|

discount | This will specify the offer value provided to the user. | 10.00 |

net_amount_debit | This will specify the actual amount deducted from the customer’s payment instrument. In case of Instant discount this amount would be lesser than the amount passed by you in the request. | 100.00 |

offer | This parameter is used to post the offer key. | newoffer1@5686 |

offer_type | This parameter is used to post any of the following offer_type:

| instant |

-

Verify the payment.

Similar to the payment response, the same parameters can be handled as part of the verify_payment API. For more information, refer to Verify Payment API,

Response parameters from verify_payment API

The following response parameters are partial list which are relevant for SKU-based offers.

| Parameter | Description | Example |

|---|---|---|

| transaction_amount | This parameter contains the total transaction amount before discount. | 50000.00 |

| net_amount_debit | This parameter contains the actual amount deducted from the customer’s payment instrument. In case of Instant discount this amount would be lesser than the amount passed by you in the request. | 47500.00 |

| discount | This parameter contains the offer value provided to the user. This value will specify the offer amount for both Instant discount and Cashback offers. | 2500.00 |

For the sample request and response from PayU, refer to Collect Payment API - PayU Hosted Checkout.

- If you want to refund the payment to customer. refer to Refund APIs.

PayU would refund the exact amount passed by you in the Refund request. For more information, refer to Refunds for Offers.

Note: You can enable the Enforce Offer flag by requesting your PayU Key Account Manager. If you enable the Enforce Offer flag, all the offers passed are visible to the customer and the customer chooses an offer that they wish to apply.

SKU-Based offer

After you create an SKU-based offer on PayU Dashboard, you can start collecting payments for products with an SKU-based offer.

This section describes the customer workflow with an SKU-based offer on the PayU Payment page when redirected from your website for payment and request parameters for the _payment API to collect payments with an SKU-Based Offer.

Note: For payment journey of instant discount offers using Redirection Flow or PayU Hosted Checkout, refer to Integrate with PayU Hosted Checkout.

Customer journey

Customer journey

After your customer selects the items from your website (for example, mobile online shopping), the customer is redirected to the PayU page for payment and involves the following steps:

- Select Offers at the top-right corner.

All the offers for the products in the shopping cart (if any) are listed.

-

Select the Product Offers tab.

The Product Offers tab is displayed on the Offer & Discount page.

-

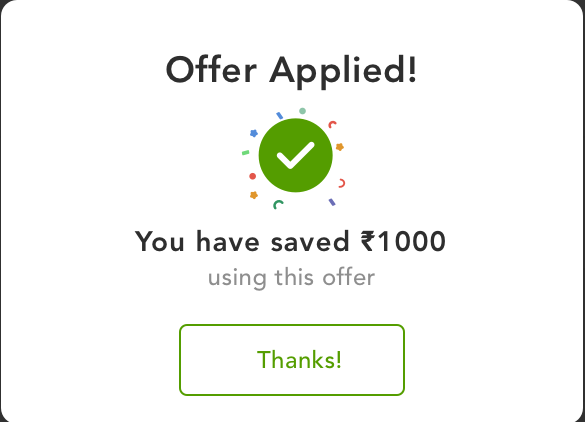

Apply an offer using the Use Offer button for the offer you wish to apply.

The Offer Applied! pop-up page is displayed.

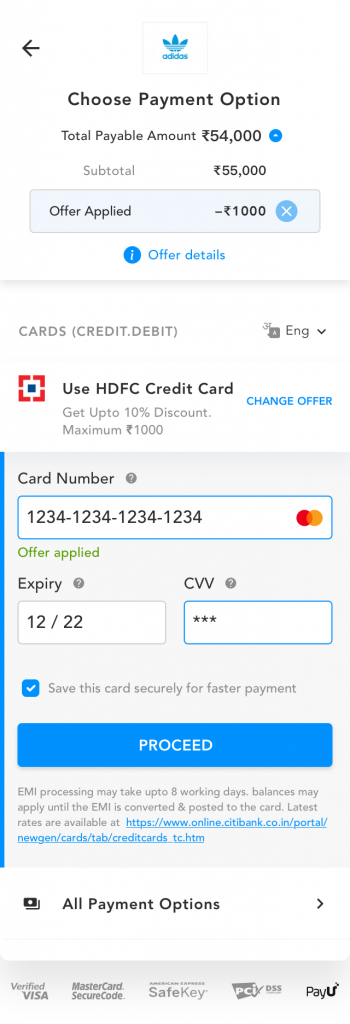

-

Click Thanks.

The page to collect your credit card details is displayed.

- Click Proceed to make payment and then enter the OTP sent by bank to your mobile to complete the purchase.

- Close this page to return back to the merchant website.

Integration steps

Step 1: Post request parameters

Request parameters

Additional request parameters for SKU-Based Offer

The following request parameters are posted along with request parameters posted for a PayU Hosted Checkout transaction. For the checkout flow and list of request parameters required for the Offer integration, refer to Collect Payment API - PayU Hosted Checkout.

Field | Description |

|---|---|

cart_details

|

|

cart_details.amount

|

|

cart_details.surcharges

|

|

cart_details.pre_discount

|

|

cart_details.items

|

|

cart_details.sku_details

|

|

cart_details.sku_details.sku_id

|

|

sku_details.sku_name

|

|

sku_details.quantity

|

|

sku_details.amount_per_sku

|

|

sku_details.offer_key

|

|

sku_details.offer_auto_apply

|

|

Sample request

curl --location 'https://test.payu.in/_payment' \

--header 'Content-Type: application/x-www-form-urlencoded' \

--header 'Cookie: PHPSESSID=nbn8otc350bsv6u5fqvhcbo73b; PHPSESSID=63a0499eaf13e' \

--data-urlencode 'key=JF****g' \

--data-urlencode 'txnid=jYhbOYH9o4' \

--data-urlencode 'amount=10' \

--data-urlencode 'productinfo=Product_info' \

--data-urlencode 'firstname=Ashish' \

--data-urlencode 'lastname=Test' \

--data-urlencode '[email protected]' \

--data-urlencode 'phone=9876543210' \

--data-urlencode 'furl=http://pp30admin.payu.in/test_response' \

--data-urlencode 'surl=http://pp30admin.payu.in/test_response' \

--data-urlencode 'api_version=19' \

--data-urlencode 'hash=e5b286a9c8545038de9d4e4ee4d8a2fd02e821015aff7e0323807ba174997d8643f9aa174981385e3e4dfe60b918650806ccb97b3e8e3471e1985ecadefd0184' \

--data-urlencode 'cart_details={

"amount": 55000,

"items": 2,

"surcharges": 10,

"pre_discount": 5,

"sku_details": [

{

"sku_id": "smartphone234",

"sku_name": "Smartphone",

"amount_per_sku": "45000",

"quantity": 1,

"offer_key": null,

"offer_auto_apply": true

},

{

"sku_id": "smartwatch132",

"sku_name": "Smartwatch",

"amount_per_sku": "10000",

"quantity": 1,

"offer_key": ["flat500@2022"],

"offer_auto_apply": false

}

]

}'async function makePayURequest() {

const url = "https://test.payu.in/_payment";

// Define cart details object

const cartDetails = {

amount: 55000,

items: 2,

surcharges: 10,

pre_discount: 5,

sku_details: [

{

sku_id: "smartphone234",

sku_name: "Smartphone",

amount_per_sku: "45000",

quantity: 1,

offer_key: null,

offer_auto_apply: true

},

{

sku_id: "smartwatch132",

sku_name: "Smartwatch",

amount_per_sku: "10000",

quantity: 1,

offer_key: ["flat500@2022"],

offer_auto_apply: false

}

]

};

// Define form data

const formData = new URLSearchParams({

'key': 'JF****g',

'txnid': 'jYhbOYH9o4',

'amount': '10',

'productinfo': 'Product_info',

'firstname': 'Ashish',

'lastname': 'Test',

'email': '[email protected]',

'phone': '9876543210',

'furl': 'http://pp30admin.payu.in/test_response',

'surl': 'http://pp30admin.payu.in/test_response',

'api_version': '19',

'hash': 'e5b286a9c8545038de9d4e4ee4d8a2fd02e821015aff7e0323807ba174997d8643f9aa174981385e3e4dfe60b918650806ccb97b3e8e3471e1985ecadefd0184',

'cart_details': JSON.stringify(cartDetails)

});

try {

console.log('Making request to:', url);

console.log('Cart details:', cartDetails);

const response = await fetch(url, {

method: 'POST',

headers: {

'Content-Type': 'application/x-www-form-urlencoded',

'Cookie': 'PHPSESSID=nbn8otc350bsv6u5fqvhcbo73b; PHPSESSID=63a0499eaf13e'

},

body: formData

});

console.log('Response status:', response.status);

console.log('Response headers:', response.headers);

// Check if response is successful

if (!response.ok) {

throw new Error(`HTTP error! status: ${response.status}, statusText: ${response.statusText}`);

}

const data = await response.text();

console.log('Success! Response data:', data);

return {

success: true,

status: response.status,

data: data

};

} catch (error) {

console.error('Request failed:', error);

return {

success: false,

error: error.message

};

}

}

// Call the function

makePayURequest()

.then(result => {

if (result.success) {

console.log('Payment request completed successfully');

} else {

console.log('Payment request failed:', result.error);

}

});

import requests

import json

# Define the URL

url = "https://test.payu.in/_payment"

# Define headers

headers = {

'Content-Type': 'application/x-www-form-urlencoded',

'Cookie': 'PHPSESSID=nbn8otc350bsv6u5fqvhcbo73b; PHPSESSID=63a0499eaf13e'

}

# Define the cart details as a dictionary first, then convert to JSON string

cart_details = {

"amount": 55000,

"items": 2,

"surcharges": 10,

"pre_discount": 5,

"sku_details": [

{

"sku_id": "smartphone234",

"sku_name": "Smartphone",

"amount_per_sku": "45000",

"quantity": 1,

"offer_key": None,

"offer_auto_apply": True

},

{

"sku_id": "smartwatch132",

"sku_name": "Smartwatch",

"amount_per_sku": "10000",

"quantity": 1,

"offer_key": ["flat500@2022"],

"offer_auto_apply": False

}

]

}

# Define form data

data = {

'key': 'JF****g',

'txnid': 'jYhbOYH9o4',

'amount': '10',

'productinfo': 'Product_info',

'firstname': 'Ashish',

'lastname': 'Test',

'email': '[email protected]',

'phone': '9876543210',

'furl': 'http://pp30admin.payu.in/test_response',

'surl': 'http://pp30admin.payu.in/test_response',

'api_version': '19',

'hash': 'e5b286a9c8545038de9d4e4ee4d8a2fd02e821015aff7e0323807ba174997d8643f9aa174981385e3e4dfe60b918650806ccb97b3e8e3471e1985ecadefd0184',

'cart_details': json.dumps(cart_details)

}

# Make the request

response = requests.post(url, headers=headers, data=data)

print("Status Code:", response.status_code)

print("Response:", response.text)

<?php

// For Laravel or similar frameworks

use Illuminate\Support\Facades\Http;

use Illuminate\Support\Facades\Log;

class PayUService

{

private $apiUrl;

private $timeout;

public function __construct()

{

$this->apiUrl = config('payu.api_url', 'https://test.payu.in/_payment');

$this->timeout = config('payu.timeout', 30);

}

public function processPayment(array $paymentData, array $cartDetails): array

{

try {

// Add cart details as JSON

$formData = array_merge($paymentData, [

'cart_details' => json_encode($cartDetails, JSON_UNESCAPED_SLASHES)

]);

Log::info('PayU Payment Request', [

'txnid' => $paymentData['txnid'] ?? 'N/A',

'amount' => $paymentData['amount'] ?? 'N/A'

]);

// Make HTTP request using Laravel's HTTP client

$response = Http::timeout($this->timeout)

->withHeaders([

'Content-Type' => 'application/x-www-form-urlencoded',

'Cookie' => 'PHPSESSID=nbn8otc350bsv6u5fqvhcbo73b; PHPSESSID=63a0499eaf13e'

])

->asForm()

->post($this->apiUrl, $formData);

Log::info('PayU Payment Response', [

'status' => $response->status(),

'txnid' => $paymentData['txnid'] ?? 'N/A'

]);

if ($response->successful()) {

return [

'success' => true,

'status_code' => $response->status(),

'response' => $response->body(),

'transaction_id' => $paymentData['txnid'] ?? null

];

} else {

throw new \Exception("HTTP Error: " . $response->status());

}

} catch (\Exception $e) {

Log::error('PayU Payment Failed', [

'error' => $e->getMessage(),

'txnid' => $paymentData['txnid'] ?? 'N/A'

]);

return [

'success' => false,

'error' => $e->getMessage(),

'transaction_id' => $paymentData['txnid'] ?? null

];

}

}

}

// Usage in Laravel Controller

class PaymentController extends Controller

{

protected $payuService;

public function __construct(PayUService $payuService)

{

$this->payuService = $payuService;

}

public function processPayment(Request $request)

{

$paymentData = [

'key' => 'JF****g',

'txnid' => 'jYhbOYH9o4',

'amount' => '10',

'productinfo' => 'Product_info',

'firstname' => 'Ashish',

'lastname' => 'Test',

'email' => '[email protected]',

'phone' => '9876543210',

'furl' => 'http://pp30admin.payu.in/test_response',

'surl' => 'http://pp30admin.payu.in/test_response',

'api_version' => '19',

'hash' => 'e5b286a9c8545038de9d4e4ee4d8a2fd02e821015aff7e0323807ba174997d8643f9aa174981385e3e4dfe60b918650806ccb97b3e8e3471e1985ecadefd0184'

];

$cartDetails = [

"amount" => 55000,

"items" => 2,

"surcharges" => 10,

"pre_discount" => 5,

"sku_details" => [

[

"sku_id" => "smartphone234",

"sku_name" => "Smartphone",

"amount_per_sku" => "45000",

"quantity" => 1,

"offer_key" => null,

"offer_auto_apply" => true

],

[

"sku_id" => "smartwatch132",

"sku_name" => "Smartwatch",

"amount_per_sku" => "10000",

"quantity" => 1,

"offer_key" => ["flat500@2022"],

"offer_auto_apply" => false

]

]

];

$result = $this->payuService->processPayment($paymentData, $cartDetails);

return response()->json($result);

}

}

?>

import java.io.*;

import java.net.HttpURLConnection;

import java.net.URL;

import java.net.URLEncoder;

import java.nio.charset.StandardCharsets;

import java.util.HashMap;

import java.util.Map;

import java.util.StringJoiner;

public class PayURequest {

public static void main(String[] args) throws IOException {

String url = "https://test.payu.in/_payment";

// Cart details JSON string

String cartDetails = "{\n" +

" \"amount\": 55000,\n" +

" \"items\": 2,\n" +

" \"surcharges\": 10,\n" +

" \"pre_discount\": 5,\n" +

" \"sku_details\": [\n" +

" {\n" +

" \"sku_id\": \"smartphone234\",\n" +

" \"sku_name\": \"Smartphone\",\n" +

" \"amount_per_sku\": \"45000\",\n" +

" \"quantity\": 1,\n" +

" \"offer_key\": null,\n" +

" \"offer_auto_apply\": true\n" +

" },\n" +

" {\n" +

" \"sku_id\": \"smartwatch132\",\n" +

" \"sku_name\": \"Smartwatch\",\n" +

" \"amount_per_sku\": \"10000\",\n" +

" \"quantity\": 1,\n" +

" \"offer_key\": [\"flat500@2022\"],\n" +

" \"offer_auto_apply\": false\n" +

" }\n" +

" ]\n" +

"}";

// Prepare form data

Map<String, String> parameters = new HashMap<>();

parameters.put("key", "JF****g");

parameters.put("txnid", "jYhbOYH9o4");

parameters.put("amount", "10");

parameters.put("productinfo", "Product_info");

parameters.put("firstname", "Ashish");

parameters.put("lastname", "Test");

parameters.put("email", "[email protected]");

parameters.put("phone", "9876543210");

parameters.put("furl", "http://pp30admin.payu.in/test_response");

parameters.put("surl", "http://pp30admin.payu.in/test_response");

parameters.put("api_version", "19");

parameters.put("hash", "e5b286a9c8545038de9d4e4ee4d8a2fd02e821015aff7e0323807ba174997d8643f9aa174981385e3e4dfe60b918650806ccb97b3e8e3471e1985ecadefd0184");

parameters.put("cart_details", cartDetails);

// Build URL-encoded string

StringJoiner sj = new StringJoiner("&");

for (Map.Entry<String, String> entry : parameters.entrySet()) {

sj.add(URLEncoder.encode(entry.getKey(), StandardCharsets.UTF_8) + "=" +

URLEncoder.encode(entry.getValue(), StandardCharsets.UTF_8));

}

byte[] postData = sj.toString().getBytes(StandardCharsets.UTF_8);

// Create connection

URL obj = new URL(url);

HttpURLConnection connection = (HttpURLConnection) obj.openConnection();

// Set request method and headers

connection.setRequestMethod("POST");

connection.setRequestProperty("Content-Type", "application/x-www-form-urlencoded");

connection.setRequestProperty("Cookie", "PHPSESSID=nbn8otc350bsv6u5fqvhcbo73b; PHPSESSID=63a0499eaf13e");

connection.setRequestProperty("Content-Length", String.valueOf(postData.length));

connection.setDoOutput(true);

// Send request

try (DataOutputStream wr = new DataOutputStream(connection.getOutputStream())) {

wr.write(postData);

}

// Read response

int responseCode = connection.getResponseCode();

BufferedReader in = new BufferedReader(new InputStreamReader(connection.getInputStream()));

String inputLine;

StringBuilder response = new StringBuilder();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println("Response Code: " + responseCode);

System.out.println("Response: " + response.toString());

}

}

using System;

using System.Collections.Generic;

using System.Net.Http;

using System.Text;

using System.Threading.Tasks;

using Newtonsoft.Json;

class Program

{

static async Task Main(string[] args)

{

var client = new HttpClient();

var url = "https://test.payu.in/_payment";

// Define cart details

var cartDetails = new

{

amount = 55000,

items = 2,

surcharges = 10,

pre_discount = 5,

sku_details = new[]

{

new

{

sku_id = "smartphone234",

sku_name = "Smartphone",

amount_per_sku = "45000",

quantity = 1,

offer_key = (string)null,

offer_auto_apply = true

},

new

{

sku_id = "smartwatch132",

sku_name = "Smartwatch",

amount_per_sku = "10000",

quantity = 1,

offer_key = new[] { "flat500@2022" },

offer_auto_apply = false

}

}

};

// Prepare form data

var formData = new List<KeyValuePair<string, string>>

{

new KeyValuePair<string, string>("key", "JF****g"),

new KeyValuePair<string, string>("txnid", "jYhbOYH9o4"),

new KeyValuePair<string, string>("amount", "10"),

new KeyValuePair<string, string>("productinfo", "Product_info"),

new KeyValuePair<string, string>("firstname", "Ashish"),

new KeyValuePair<string, string>("lastname", "Test"),

new KeyValuePair<string, string>("email", "[email protected]"),

new KeyValuePair<string, string>("phone", "9876543210"),

new KeyValuePair<string, string>("furl", "http://pp30admin.payu.in/test_response"),

new KeyValuePair<string, string>("surl", "http://pp30admin.payu.in/test_response"),

new KeyValuePair<string, string>("api_version", "19"),

new KeyValuePair<string, string>("hash", "e5b286a9c8545038de9d4e4ee4d8a2fd02e821015aff7e0323807ba174997d8643f9aa174981385e3e4dfe60b918650806ccb97b3e8e3471e1985ecadefd0184"),

new KeyValuePair<string, string>("cart_details", JsonConvert.SerializeObject(cartDetails))

};

var formContent = new FormUrlEncodedContent(formData);

// Set headers

client.DefaultRequestHeaders.Add("Cookie", "PHPSESSID=nbn8otc350bsv6u5fqvhcbo73b; PHPSESSID=63a0499eaf13e");

try

{

var response = await client.PostAsync(url, formContent);

var responseContent = await response.Content.ReadAsStringAsync();

Console.WriteLine($"Status Code: {response.StatusCode}");

Console.WriteLine($"Response: {responseContent}");

}

catch (Exception ex)

{

Console.WriteLine($"Error: {ex.Message}");

}

}

}

cart_details object in sample request

"cart_details": {

"amount": 55000,

"items": 2,

"surcharges": 10,

"pre_discount": 5,

"sku_details": [

{

"sku_id": "smartphone234",

"sku_name": "Smartphone",

"amount_per_sku": "45000",

"quantity": 1,

"offer_key": null,

"offer_auto_apply": true

},

{

"sku_id": "smartwatch132",

"sku_name": "Smartwatch",

"amount_per_sku": "10000",

"quantity": 1,

"offer_key": [

"flat500@2022"

],

"offer_auto_apply": false

}

]

}Step 2: Check the PayU response

Sample response

Success scenario

The cart_details JSON Object in the response (sample):

{"cart_details": {

"id": "18",

"payu_id": "999000000000983",

"total_items": "2",

"total_cart_amount": "55000",

"offer_applied": null,

"offer_availed": null,

"instant_discount": "1000",

"cashback_discount": "500",

"total_discount": "1500",

"net_cart_amount": "54000",

"created_at": null,

"updated_at": null,

"sku_details": [

{

"id": "35",

"cart_id": "18",

"payu_id": "999000000000983",

"mid": "180012",

"sku_id": "smartphone234",

"sku_name": "Smartphone",

"amount_per_sku": "45000.00",

"quantity": "1",

"amount_before_discount": "45000",

"discount": "1000",

"amount_after_discount": "44000",

"offer_key": null,

"offer_status": null,

"offer_type": null,

"created_at": null,

"updated_at": null

},

{

"id": "36",

"cart_id": "18",

"payu_id": "999000000000983",

"mid": "180012",

"sku_id": "smartwatch132",

"sku_name": "Smartwatch",

"amount_per_sku": "10000.00",

"quantity": "1",

"amount_before_discount": "10000.00",

"discount": "500",

"amount_after_discount": "10000.00",

"offer_key": null,

"offer_status": null,

"offer_type": null,

"created_at": null,

"updated_at": null

}

]

}}Failure scenarios

For a list of error messages for the failure scenarios, refer to Error Codes for Offers Integration.

Step 3: Verify Payment

Verify the payment using the Verify Payment API. For more information, For API reference, refer to Verify Payment API.

Updated 2 months ago