PayPal Integration

Integrate PayU with PayPal wallets to facilitate international payments. PayPal can be seamlessly integrated with your PayU Hosted or Merchant Hosted Checkout integration. Customers have the option to utilize PayPal Currency Conversion to convert international payments from INR (or other currencies) to their chosen currency. This ensures businesses can continue accepting payments via PayPal. Payments made through PayPal are directly transferred to your PayPal wallet, with settlements processed in INR.

You can accept payments within the transaction limits of your PayU account. Discover more about alternative payment methods and their respective transaction limits. This section describes the following:

Customer journey

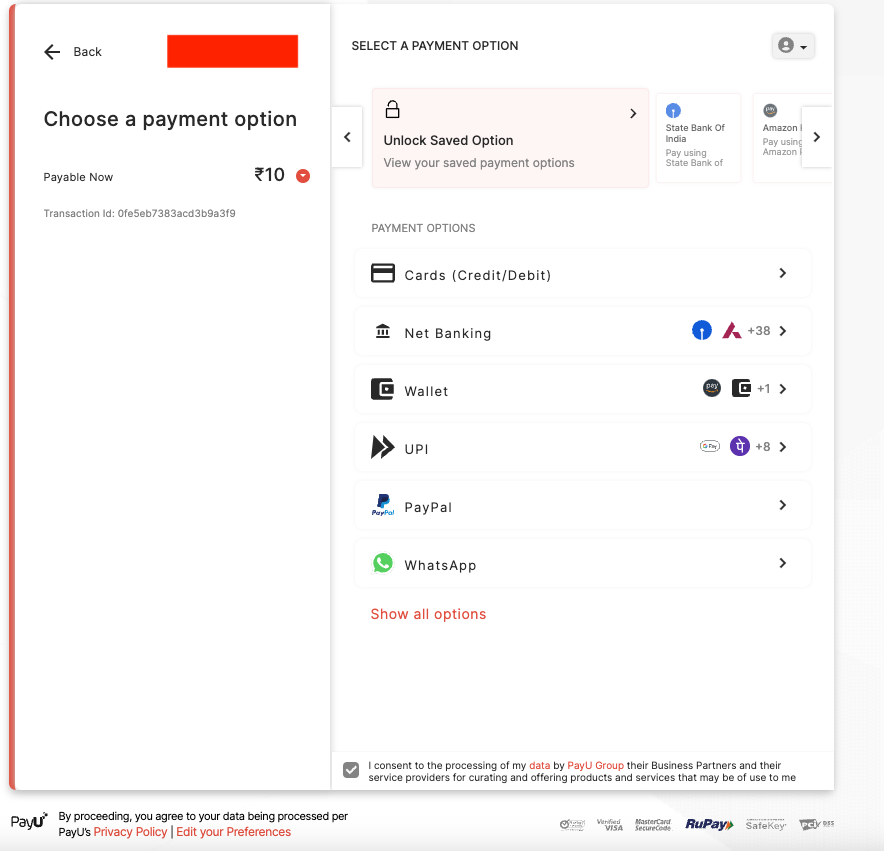

- Customer is redirected to PayU Payment page.

- Customer selects the Wallets option.

- Customer selects the Paypal option.

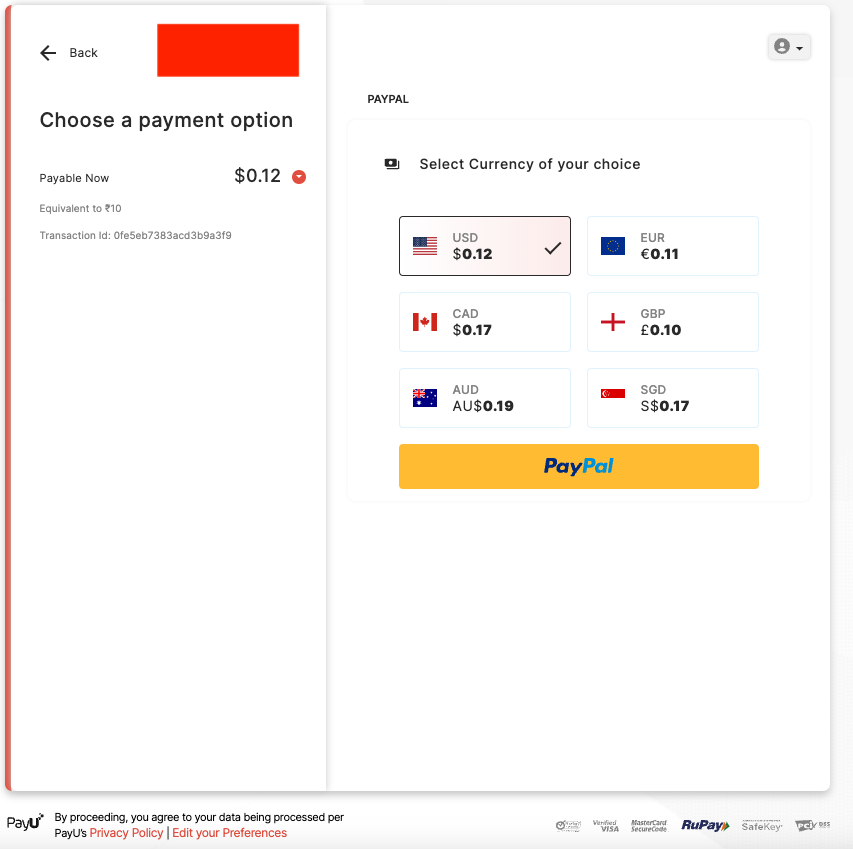

-

Customer selects the preferred currency and clicks PayPal.

The success or failure response is sent back to you by PayU after vaerfication.

Benefits

Incorporating PayU into your Checkout system offers several benefits:

- Improved Success Rates: Experience success rates up to 20% higher.

- Accelerated Settlement: Receive payments on a T+1 settlement schedule.

- Extensive User Base: Access over 30 Crore PayPal users worldwide.

- No Extra Charges: Transaction rates are determined by PayPal.

- Currency Conversion: Facilitate currency conversions from INR to your customers' preferred currencies.

Steps to Integrate

Initiate the payment to PayU with pg=PAYPAL and bankcode=PAYPAL

Check the response from PayU

Verify the payment using verify_payment and monitor using webhooks

Step 1: Initiate the payment to PayU

You need use bankcode as PAYPAL with the pg as PAYPAL.

Reference: For the Try It experience ), refer to Collect Payments API under API Reference.

Request parameters

| Test Environment | https://test.payu.in/_payment |

| Production Environment | https://secure.payu.in/_payment |

| Parameter | Description | Example |

|---|---|---|

key mandatory | String - This parameter is the unique merchant key provided by PayU for your merchant account. For more information, refer to Generate Merchant Key and Salt. | 8488225 |

txnid mandatory | varchar - This parameter is known as Transaction ID (or OrderID). It is the order reference number generated at your (Merchant's) end. It is an identifier which you(merchant) would use to track a particular order. If a transaction using a particular transaction ID has already been successful at PayU, the usage of same Transaction ID again would fail. Hence, it is essential that you post us a unique transaction ID for every new transaction. | fd3e847h2 |

amount mandatory | float - This parameter should contain the payment amount of the particular transaction. Note: Type-cast the amount to float type | 10 |

productinfo mandatory | varchar - This parameter should contain a brief product description. It should be a string describing the product (The description type is entirely your choice). | T-shirt |

firstname mandatory | varchar - This parameter must contain the first name of the customer. | Ankit |

email mandatory | varchar - This parameter must contain the email of the customer | [email protected] |

phone mandatory | integer - Merchant needs to take the customer's GPay registered phone number and pass in this field. This field will be used for further mapping the customer VPA and initiate a collect request. | 9876543210 |

pg mandatory | string - It defines the payment category using the Merchant Hosted Checkout integration. For a Wallet payment, "PAYPAL" must be specified in the pg parameter. | PAYPAL |

bankcode mandatory | string - The merchant must post PAYPAL as the value for this parameter. | PAYPAL |

surl mandatory | The "surl" field is the success URL, which is the page PayU will redirect to if the transaction is successful. The merchant can handle the response at this URL after the customer is redirected there. | https://apiplayground-response.herokuapp.com/ |

furl mandatory | The "furl" field is the Failure URL, which is the page PayU will redirect to if the transaction is failed. The merchant can handle the response at this URL after the customer is redirected there. | https://apiplayground-response.herokuapp.com/ |

hash mandatory | string - The hash calculated by the merchant using the key and salt provided by PayU. The format for calculating the hash: sha512(key\|txnid\|amount\|productinfo\|firstname\|email\|udf1\|udf2\|udf3\|udf4\|udf5\|\|\|\|\|SALT) For more information, refer to Generate Hash. | calculated_hash_value |

lastname optional | string - The last name of the customer. | Kumar |

address1 optional | string - The first line of the billing address. | 123 Main St |

address2 optional | string - The second line of the billing address. | Apt 4B |

city optional | string - The city where your customer resides as part of the billing address. | Mumbai |

state optional | string - The state where your customer resides as part of the billing address. | Maharashtra |

country optional | string - The country where your customer resides. | India |

zipcode optional | string - Billing address zip code is mandatory for the cardless EMI option. | 400001 |

udf1 optional | string - This parameter has been made for you to keep any information corresponding to the transaction. | custom_data_1 |

udf2 optional | string - This parameter has been made for you to keep any information corresponding to the transaction. | custom_data_2 |

udf3 optional | string - This parameter has been made for you to keep any information corresponding to the transaction. | custom_data_3 |

udf4 optional | string - This parameter has been made for you to keep any information corresponding to the transaction. | custom_data_4 |

udf5 optional | string - This parameter has been made for you to keep any information corresponding to the transaction. | custom_data_5 |

Understanding Hashing and sample code

Hashing

You must hash the request parameters using the following hash logic:

sha512(key|txnid|amount|productinfo|firstname|email|udf1|udf2|udf3|udf4|udf5||||||SALT)For more information, refer to Generate Hash.

Hashing Sample Code

<?php

function generateHash($params, $salt) {

// Extract parameters or use empty string if not provided

$key = $params['key'];

$txnid = $params['txnid'];

$amount = $params['amount'];

$productinfo = $params['productinfo'];

$firstname = $params['firstname'];

$email = $params['email'];

$udf1 = isset($params['udf1']) ? $params['udf1'] : '';

$udf2 = isset($params['udf2']) ? $params['udf2'] : '';

$udf3 = isset($params['udf3']) ? $params['udf3'] : '';

$udf4 = isset($params['udf4']) ? $params['udf4'] : '';

$udf5 = isset($params['udf5']) ? $params['udf5'] : '';

// Construct hash string with exact parameter sequence

$hashString = $key . '|' . $txnid . '|' . $amount . '|' . $productinfo . '|' .

$firstname . '|' . $email . '|' . $udf1 . '|' . $udf2 . '|' .

$udf3 . '|' . $udf4 . '|' . $udf5 . '||||||' . $salt;

// Generate hash and convert to lowercase

return strtolower(hash('sha512', $hashString));

}

// Example usage

$params = [

'key' => 'yourKey',

'txnid' => 'yourTxnId',

'amount' => 'yourAmount',

'productinfo' => 'yourProductInfo',

'firstname' => 'yourFirstName',

'email' => 'yourEmail',

'udf1' => 'optional_value1'

// udf2, udf3, udf4, udf5 not provided - will be empty strings

];

$salt = 'yourSalt';

$hash = generateHash($params, $salt);

echo 'Generated Hash: ' . $hash;

?>

import java.nio.charset.StandardCharsets;

import java.security.MessageDigest;

import java.security.NoSuchAlgorithmException;

import java.util.HashMap;

import java.util.Map;

public class ImprovedHashGenerator {

public static String generateHash(Map<String, String> params, String salt) {

// Extract parameters or use empty string if not provided

String key = params.get("key");

String txnid = params.get("txnid");

String amount = params.get("amount");

String productinfo = params.get("productinfo");

String firstname = params.get("firstname");

String email = params.get("email");

String udf1 = params.getOrDefault("udf1", "");

String udf2 = params.getOrDefault("udf2", "");

String udf3 = params.getOrDefault("udf3", "");

String udf4 = params.getOrDefault("udf4", "");

String udf5 = params.getOrDefault("udf5", "");

// Construct hash string with exact parameter sequence

String hashString = key + "|" + txnid + "|" + amount + "|" + productinfo + "|" +

firstname + "|" + email + "|" + udf1 + "|" + udf2 + "|" +

udf3 + "|" + udf4 + "|" + udf5 + "||||||" + salt;

return sha512(hashString);

}

private static String sha512(String input) {

try {

MessageDigest md = MessageDigest.getInstance("SHA-512");

byte[] hashBytes = md.digest(input.getBytes(StandardCharsets.UTF_8));

StringBuilder sb = new StringBuilder();

for (byte b : hashBytes) {

sb.append(String.format("%02x", b));

}

return sb.toString().toLowerCase();

} catch (NoSuchAlgorithmException e) {

throw new RuntimeException(e);

}

}

public static void main(String[] args) {

// Example usage with parameters map

Map<String, String> params = new HashMap<>();

params.put("key", "yourKey");

params.put("txnid", "yourTxnId");

params.put("amount", "yourAmount");

params.put("productinfo", "yourProductInfo");

params.put("firstname", "yourFirstName");

params.put("email", "yourEmail");

params.put("udf1", "optional_value1");

// udf2, udf3, udf4, udf5 not provided - will be empty strings

String salt = "yourSalt";

String hash = generateHash(params, salt);

System.out.println("Generated Hash: " + hash);

}

}

using System;

using System.Collections.Generic;

using System.Security.Cryptography;

using System.Text;

public class ImprovedHashGenerator

{

public static string GenerateHash(Dictionary<string, string> parameters, string salt)

{

// Extract parameters or use empty string if not provided

string key = parameters["key"];

string txnid = parameters["txnid"];

string amount = parameters["amount"];

string productinfo = parameters["productinfo"];

string firstname = parameters["firstname"];

string email = parameters["email"];

// Get UDF values if present, otherwise use empty string

string udf1 = parameters.ContainsKey("udf1") ? parameters["udf1"] : "";

string udf2 = parameters.ContainsKey("udf2") ? parameters["udf2"] : "";

string udf3 = parameters.ContainsKey("udf3") ? parameters["udf3"] : "";

string udf4 = parameters.ContainsKey("udf4") ? parameters["udf4"] : "";

string udf5 = parameters.ContainsKey("udf5") ? parameters["udf5"] : "";

// Construct hash string with exact parameter sequence

string hashString = $"{key}|{txnid}|{amount}|{productinfo}|{firstname}|{email}|{udf1}|{udf2}|{udf3}|{udf4}|{udf5}||||||{salt}";

return Sha512(hashString);

}

private static string Sha512(string input)

{

using (SHA512 sha512 = SHA512.Create())

{

byte[] bytes = sha512.ComputeHash(Encoding.UTF8.GetBytes(input));

StringBuilder sb = new StringBuilder();

foreach (byte b in bytes)

{

sb.Append(b.ToString("x2"));

}

return sb.ToString().ToLower();

}

}

public static void Main(string[] args)

{

// Example usage with parameters dictionary

Dictionary<string, string> parameters = new Dictionary<string, string>

{

["key"] = "yourKey",

["txnid"] = "yourTxnId",

["amount"] = "yourAmount",

["productinfo"] = "yourProductInfo",

["firstname"] = "yourFirstName",

["email"] = "yourEmail",

["udf1"] = "optional_value1"

// udf2, udf3, udf4, udf5 not provided - will be empty strings

};

string salt = "yourSalt";

string hash = GenerateHash(parameters, salt);

Console.WriteLine("Generated Hash: " + hash);

}

}import hashlib

def generate_hash(params, salt):

# Extract parameters or use empty string if not provided

key = params['key']

txnid = params['txnid']

amount = params['amount']

productinfo = params['productinfo']

firstname = params['firstname']

email = params['email']

udf1 = params.get('udf1', '')

udf2 = params.get('udf2', '')

udf3 = params.get('udf3', '')

udf4 = params.get('udf4', '')

udf5 = params.get('udf5', '')

# Construct hash string with exact parameter sequence

hash_string = f"{key}|{txnid}|{amount}|{productinfo}|{firstname}|{email}|{udf1}|{udf2}|{udf3}|{udf4}|{udf5}||||||{salt}"

# Generate SHA-512 hash

return hashlib.sha512(hash_string.encode('utf-8')).hexdigest()

# Example usage

params = {

'key': 'yourKey',

'txnid': 'yourTxnId',

'amount': 'yourAmount',

'productinfo': 'yourProductInfo',

'firstname': 'yourFirstName',

'email': 'yourEmail',

'udf1': 'optional_value1'

# udf2, udf3, udf4, udf5 not provided - will default to empty strings

}

salt = 'yourSalt'

hash_value = generate_hash(params, salt)

print("Generated Hash:", hash_value)

const crypto = require('crypto');

function generateHash(params, salt) {

// Extract parameters or use empty string if not provided

const key = params.key;

const txnid = params.txnid;

const amount = params.amount;

const productinfo = params.productinfo;

const firstname = params.firstname;

const email = params.email;

const udf1 = params.udf1 || '';

const udf2 = params.udf2 || '';

const udf3 = params.udf3 || '';

const udf4 = params.udf4 || '';

const udf5 = params.udf5 || '';

// Construct hash string with exact parameter sequence

const hashString = `${key}|${txnid}|${amount}|${productinfo}|${firstname}|${email}|${udf1}|${udf2}|${udf3}|${udf4}|${udf5}||||||${salt}`;

// Generate SHA-512 hash

return crypto.createHash('sha512').update(hashString).digest('hex');

}

// Example usage

const params = {

key: 'yourKey',

txnid: 'yourTxnId',

amount: 'yourAmount',

productinfo: 'yourProductInfo',

firstname: 'yourFirstName',

email: 'yourEmail',

udf1: 'optional_value1'

// udf2, udf3, udf4, udf5 not provided - will default to empty strings

};

const salt = 'yourSalt';

const hash = generateHash(params, salt);

console.log("Generated Hash:", hash);

Sample request

curl -X POST "https://test.payu.in/_payment" \

-H "accept: application/json" \

-H "Content-Type: application/x-www-form-urlencoded" \

-d "key=J****g&txnid=aI1UM19ONxLgPz&amount=10.00&firstname=Ashish&[email protected]&phone=9876543210&productinfo=iPhone&pg=PAYPAL&bankcode=PAYPAL&surl=https://apiplayground-response.herokuapp.com/&furl=https://apiplayground-response.herokuapp.com/&hash=6840ba0d1a14554f7ee5d20966dfbac6b221718e72dd823f05b6da01420286315b4956c28325898b66520b111604020ea2c547608606674766eb7e4164dc0baa"import requests

url = "https://test.payu.in/_payment"

headers = {

"accept": "application/json",

"Content-Type": "application/x-www-form-urlencoded"

}

data = {

"key": "J****g",

"txnid": "aI1UM19ONxLgPz",

"amount": "10.00",

"firstname": "Ashish",

"email": "[email protected]",

"phone": "9876543210",

"productinfo": "iPhone",

"pg": "PAYPAL",

"bankcode": "PAYPAL",

"surl": "https://apiplayground-response.herokuapp.com/",

"furl": "https://apiplayground-response.herokuapp.com/",

"hash": "6840ba0d1a14554f7ee5d20966dfbac6b221718e72dd823f05b6da01420286315b4956c28325898b66520b111604020ea2c547608606674766eb7e4164dc0baa"

}

response = requests.post(url, headers=headers, data=data)

print(response.status_code)

print(response.text)using System;

using System.Collections.Generic;

using System.Net.Http;

using System.Threading.Tasks;

class Program

{

static async Task Main(string[] args)

{

using (var client = new HttpClient())

{

var url = "https://test.payu.in/_payment";

client.DefaultRequestHeaders.Add("accept", "application/json");

var formData = new List<KeyValuePair<string, string>>

{

new KeyValuePair<string, string>("key", "J****g"),

new KeyValuePair<string, string>("txnid", "aI1UM19ONxLgPz"),

new KeyValuePair<string, string>("amount", "10.00"),

new KeyValuePair<string, string>("firstname", "Ashish"),

new KeyValuePair<string, string>("email", "[email protected]"),

new KeyValuePair<string, string>("phone", "9876543210"),

new KeyValuePair<string, string>("productinfo", "iPhone"),

new KeyValuePair<string, string>("pg", "PAYPAL"),

new KeyValuePair<string, string>("bankcode", "PAYPAL"),

new KeyValuePair<string, string>("surl", "https://apiplayground-response.herokuapp.com/"),

new KeyValuePair<string, string>("furl", "https://apiplayground-response.herokuapp.com/"),

new KeyValuePair<string, string>("hash", "6840ba0d1a14554f7ee5d20966dfbac6b221718e72dd823f05b6da01420286315b4956c28325898b66520b111604020ea2c547608606674766eb7e4164dc0baa")

};

var formContent = new FormUrlEncodedContent(formData);

var response = await client.PostAsync(url, formContent);

var responseBody = await response.Content.ReadAsStringAsync();

Console.WriteLine($"Status: {response.StatusCode}");

Console.WriteLine($"Response: {responseBody}");

}

}

}async function makePayPalPayment() {

const url = "https://test.payu.in/_payment";

const headers = {

"accept": "application/json",

"Content-Type": "application/x-www-form-urlencoded"

};

const formData = new URLSearchParams({

"key": "J****g",

"txnid": "aI1UM19ONxLgPz",

"amount": "10.00",

"firstname": "Ashish",

"email": "[email protected]",

"phone": "9876543210",

"productinfo": "iPhone",

"pg": "PAYPAL",

"bankcode": "PAYPAL",

"surl": "https://apiplayground-response.herokuapp.com/",

"furl": "https://apiplayground-response.herokuapp.com/",

"hash": "6840ba0d1a14554f7ee5d20966dfbac6b221718e72dd823f05b6da01420286315b4956c28325898b66520b111604020ea2c547608606674766eb7e4164dc0baa"

});

try {

const response = await fetch(url, {

method: "POST",

headers: headers,

body: formData

});

const data = await response.text();

console.log("Status:", response.status);

console.log("Response:", data);

return data;

} catch (error) {

console.error("Error:", error);

throw error;

}

}

// Call the function

makePayPalPayment();import java.io.IOException;

import java.net.URI;

import java.net.http.HttpClient;

import java.net.http.HttpRequest;

import java.net.http.HttpResponse;

import java.util.HashMap;

import java.util.Map;

import java.util.stream.Collectors;

public class PayPalPayment {

public static void main(String[] args) throws IOException, InterruptedException {

String url = "https://test.payu.in/_payment";

Map<String, String> formData = new HashMap<>();

formData.put("key", "J****g");

formData.put("txnid", "aI1UM19ONxLgPz");

formData.put("amount", "10.00");

formData.put("firstname", "Ashish");

formData.put("email", "[email protected]");

formData.put("phone", "9876543210");

formData.put("productinfo", "iPhone");

formData.put("pg", "PAYPAL");

formData.put("bankcode", "PAYPAL");

formData.put("surl", "https://apiplayground-response.herokuapp.com/");

formData.put("furl", "https://apiplayground-response.herokuapp.com/");

formData.put("hash", "6840ba0d1a14554f7ee5d20966dfbac6b221718e72dd823f05b6da01420286315b4956c28325898b66520b111604020ea2c547608606674766eb7e4164dc0baa");

String formBody = formData.entrySet()

.stream()

.map(entry -> entry.getKey() + "=" + entry.getValue())

.collect(Collectors.joining("&"));

HttpClient client = HttpClient.newHttpClient();

HttpRequest request = HttpRequest.newBuilder()

.uri(URI.create(url))

.header("accept", "application/json")

.header("Content-Type", "application/x-www-form-urlencoded")

.POST(HttpRequest.BodyPublishers.ofString(formBody))

.build();

HttpResponse<String> response = client.send(request, HttpResponse.BodyHandlers.ofString());

System.out.println("Status Code: " + response.statusCode());

System.out.println("Response Body: " + response.body());

}

}$url = "https://test.payu.in/_payment";

$data = array(

'key' => 'J****g',

'txnid' => 'aI1UM19ONxLgPz',

'amount' => '10.00',

'firstname' => 'Ashish',

'email' => '[email protected]',

'phone' => '9876543210',

'productinfo' => 'iPhone',

'pg' => 'PAYPAL',

'bankcode' => 'PAYPAL',

'surl' => 'https://apiplayground-response.herokuapp.com/',

'furl' => 'https://apiplayground-response.herokuapp.com/',

'hash' => '6840ba0d1a14554f7ee5d20966dfbac6b221718e72dd823f05b6da01420286315b4956c28325898b66520b111604020ea2c547608606674766eb7e4164dc0baa'

);

$options = array(

'http' => array(

'header' => "accept: application/json\r\n" .

"Content-Type: application/x-www-form-urlencoded\r\n",

'method' => 'POST',

'content' => http_build_query($data)

)

);

$context = stream_context_create($options);

$response = file_get_contents($url, false, $context);

if ($response === FALSE) {

echo "Error occurred";

} else {

echo "Response: " . $response;

}

// Alternative using cURL

/*

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL, $url);

curl_setopt($ch, CURLOPT_POST, true);

curl_setopt($ch, CURLOPT_POSTFIELDS, http_build_query($data));

curl_setopt($ch, CURLOPT_RETURNTRANSFER, true);

curl_setopt($ch, CURLOPT_HTTPHEADER, array(

'accept: application/json',

'Content-Type: application/x-www-form-urlencoded'

));

$response = curl_exec($ch);

$httpCode = curl_getinfo($ch, CURLINFO_HTTP_CODE);

curl_close($ch);

echo "HTTP Code: " . $httpCode . "\n";

echo "Response: " . $response;

*/

Note:Ensure your PayPal account maintains sufficient funds before initiating a refund. Refunds can be initiated either through the PayU Dashboard or the Refund Transasction API. Refunded amounts are deducted from your PayPal account and credited to your customer's PayPal account. For more information, refer to:

Step 2: Check the response from PayU

Sample response

You must look for the following:

- PG_TYPE: PAYPAL-PG

- bankcode: PAYPAL

- field4: Amount collected in the foreign currency

- field5: Foreign currency used

- net_amount_debit: Amount debited in INR

Array

(

[mihpayid] => 403993715527518775

[mode] => PAYPAL

[status] => success

[unmappedstatus] => captured

[key] => J*****g

[txnid] => HC13glcAkssIkl

[amount] => 10.00

[discount] => 0.00

[net_amount_debit] => 10

[addedon] => 2022-10-21 17:45:24

[productinfo] => iPhone

[firstname] => Ashish

[lastname] =>

[address1] =>

[address2] =>

[city] =>

[state] =>

[country] => US

[zipcode] =>

[email] => [email protected]

[phone] => 9876543210

[udf1] =>

[udf2] =>

[udf3] =>

[udf4] =>

[udf5] =>

[udf6] =>

[udf7] =>

[udf8] =>

[udf9] =>

[udf10] =>

[hash] => 007435a716982c7f5eec5cff95701f65eb1bdbff8f852e461224e3b5e17126ad26bb3a3ffdb95cded6a87d3515fe86fc58925cad024595a4a6825adfed2dc436

[field1] =>

[field2] =>

[field3] => MCP8405944934679133147

[field4] => 0.12

[field5] => USD

[field6] =>

[field7] =>

[field8] =>

[field9] => Transaction Completed Successfully

[payment_source] => payu

[PG_TYPE] => PAYPAL-PG

[bank_ref_num] => 540898ed-72e7-40a8-a96e-f17de621cbb4

[bankcode] => PAYPAL

[error] => E000

[error_Message] => No Error

[splitInfo] => {"splitStatus":"splitNotReceived","splitSegments":[]}

)Step 3: Verify the payment

Upon receiving the response, PayU recommends you performing a reconciliation step to validate all transaction details.

You can verify your payments using either of the following methods:

Configure the webhooks to monitor the status of payments.

Webhooks enable a server to communicate with another server by sending an HTTP callback or message.

These callbacks are triggered by specific events or instances and operate at the server-to-server (S2S) level.

Know how to manage Webhooks for Payments.

Updated 5 months ago