Collect Payments with BNPL Link and Pay

BNPL like Lazypay allow your customers to checkout in "Click and Pay Later" with no hidden charges, while you get paid upfront.

You can integrate with PayU’s Pay Later stack to enable the one-click checkout feature on the payment page, across BNPLs that support link and pay flow.

Steps to integrate

Verify customer eligibility for Buy Now Pay Later options using PayU hosted checkout

Start the payment process using PayU hosted checkout integration with offers

Handle and process the response received from PayU after payment initiation

Submit and validate OTP for first-time users in the BNPL flow

Confirm the payment status and ensure successful transaction completion

Benefits and Customer Journey

Benefits for your customers

- 100% secure payments.

- Frictionless one-tap checkout experience.

- Pay later with 0% interest and no hidden charges.

- An easy sign-up process.

Advantages

- 90%+ payment success rates.

- Increase in cart conversion rates.

- Improve user retention by providing a seamless checkout experience.

- Bump in average order value.

Note:

- PayU will extend this solution for other payment options within BNPL and be expanded to wallet partners shortly.

- The same integration will enable you to integrate all such supported payment options.

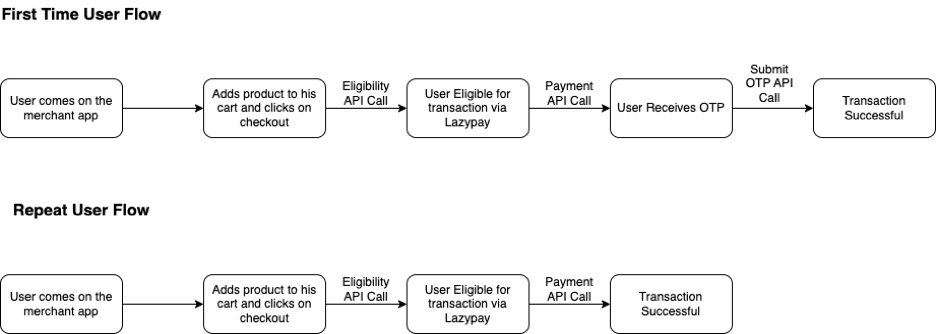

Customer Journey

The customer journey involves the First-time User and Repeat User flows:

The following steps demonstrate how Rahul (for example) makes his first transaction using Pay Later on your website or mobile app (let’s call it Demoshop):

First Time Flow

- Rahul logs in to your Demoshop, adds products/services to the cart, and proceeds to the checkout page.

- Even before landing on the checkout page, Demoshop initiates Eligibility API to check if Rahul is eligible.

- Post getting a successful eligibility response, the respective BNPL option will be shown to Rahul. (In case Rahul is not eligible, the respective lender option will be hidden/disabled on Demoshop.)

- Rahul clicks on his preferred BNPL lender’s button for which he is eligible, say Lazypay in this case. If Rahul is transacting for the first time on your Demostore, he will have to link his Lazypay account with Demoshop. (While for subsequent transactions, the transactions would be 1-click)

- Rahul will continue his transaction and go in the OTP authentication step.

- Lazypay sends an OTP for verification which John enters as part of the linking flow and also to complete his first transaction

- Once the linking is completed successfully, Lazypay shares an access token which is used for further subsequent transactions.

Repeat User Flow

The following steps demonstrate how Rahul makes his subsequent transactions using Lazypay on Demoshop:

- Rahul comes to Demoshop again. Demoshop initiates the eligibility API of the checkout page to check for his present status. Lazypay sends the current eligibility status as success.

- Rahul clicks on Lazypay and Demoshop initiates the transaction directly. Demoshop initiates the payment call to successfully place the order.

Note: User credentials will be the unique identifier for each user that will have to be passed by the merchant and will be used to identify each unique user. It will be string with the following format. abc:xyz (data type: string),abc corresponds to the merchant key and xyz corresponds to the user identifier. For example, BmzSVc:userid

The following steps are involved when collecting payment with <<glossary:BNPL>> using Link and Pay:

Step 1: Check the BNPL eligibility

Before you can initiate payment with PayU, you can check the eligibility using the Get EMI Checkout Details API. For more information, refer to Get EMI Checkout Details API.

Environment

| Test Environment | <https://test.payu.in/info/linkAndPay/get_emi_checkout_details> |

| Production Environment | <https://info.payu.in/linkAndPay/get_emi_checkout_details> |

Sample request

curl --location 'https://test.payu.in/info/linkAndPay/get_emi_checkout_details' \

--header 'x-credential-username: smsplus' \

--header 'Content-Type: application/json' \

--header 'authorization: hmac username="x0i6r2", algorithm="sha512", headers="date", signature="0e0ebc518c085d8ff49058b7c232bfe2e8779e9e9cafd34a4cdf1c11114035eea75b0e404a9b9e152757dbcc4926f78b6f18ba7f6643e2bf687a65942d3bde38"' \

--header 'date: Mon, 28 Oct 2024 10:34:49 GMT' \

--data '{

"amount": 2000000,

"userCredentials": "aaa:bbb",

"phone": "9560012582",

"bankCode": null,

"payuToken": null

}'import requests

import json

import hashlib

import hmac

from datetime import datetime

url = "https://test.payu.in/info/linkAndPay/get_emi_checkout_details"

# Generate date header in RFC 1123 format

date_header = datetime.utcnow().strftime('%a, %d %b %Y %H:%M:%S GMT')

# HMAC signature (replace with your actual signature generation logic)

authorization = 'hmac username="x0i6r2", algorithm="sha512", headers="date", signature="0e0ebc518c085d8ff49058b7c232bfe2e8779e9e9cafd34a4cdf1c11114035eea75b0e404a9b9e152757dbcc4926f78b6f18ba7f6643e2bf687a65942d3bde38"'

headers = {

"x-credential-username": "smsplus",

"Content-Type": "application/json",

"authorization": authorization,

"date": date_header

}

payload = {

"amount": 2000000,

"userCredentials": "aaa:bbb",

"phone": "9560012582",

"bankCode": None,

"payuToken": None

}

response = requests.post(url, headers=headers, json=payload)

print("Status Code:", response.status_code)

print("Response:", response.json())import java.io.IOException;

import java.net.URI;

import java.net.http.HttpClient;

import java.net.http.HttpRequest;

import java.net.http.HttpResponse;

import java.time.ZonedDateTime;

import java.time.format.DateTimeFormatter;

import java.util.Locale;

public class PayUEMICheckoutDetails {

public static void main(String[] args) throws IOException, InterruptedException {

String url = "https://test.payu.in/info/linkAndPay/get_emi_checkout_details";

// Generate date header in RFC 1123 format

String dateHeader = DateTimeFormatter

.ofPattern("EEE, dd MMM yyyy HH:mm:ss 'GMT'", Locale.ENGLISH)

.format(ZonedDateTime.now());

// HMAC authorization header (replace with your actual signature)

String authorization = "hmac username=\"x0i6r2\", algorithm=\"sha512\", headers=\"date\", signature=\"0e0ebc518c085d8ff49058b7c232bfe2e8779e9e9cafd34a4cdf1c11114035eea75b0e404a9b9e152757dbcc4926f78b6f18ba7f6643e2bf687a65942d3bde38\"";

String jsonPayload = """

{

"amount": 2000000,

"userCredentials": "aaa:bbb",

"phone": "9560012582",

"bankCode": null,

"payuToken": null

}

""";

HttpClient client = HttpClient.newHttpClient();

HttpRequest request = HttpRequest.newBuilder()

.uri(URI.create(url))

.header("x-credential-username", "smsplus")

.header("Content-Type", "application/json")

.header("authorization", authorization)

.header("date", dateHeader)

.POST(HttpRequest.BodyPublishers.ofString(jsonPayload))

.build();

HttpResponse<String> response = client.send(request, HttpResponse.BodyHandlers.ofString());

System.out.println("Status Code: " + response.statusCode());

System.out.println("Response: " + response.body());

}

}<?php

$url = "https://test.payu.in/info/linkAndPay/get_emi_checkout_details";

// Generate date header in RFC 1123 format

$dateHeader = gmdate('D, d M Y H:i:s') . ' GMT';

// HMAC authorization header (replace with your actual signature)

$authorization = 'hmac username="x0i6r2", algorithm="sha512", headers="date", signature="0e0ebc518c085d8ff49058b7c232bfe2e8779e9e9cafd34a4cdf1c11114035eea75b0e404a9b9e152757dbcc4926f78b6f18ba7f6643e2bf687a65942d3bde38"';

$payload = array(

'amount' => 2000000,

'userCredentials' => 'aaa:bbb',

'phone' => '9560012582',

'bankCode' => null,

'payuToken' => null

);

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL, $url);

curl_setopt($ch, CURLOPT_POST, true);

curl_setopt($ch, CURLOPT_POSTFIELDS, json_encode($payload));

curl_setopt($ch, CURLOPT_RETURNTRANSFER, true);

curl_setopt($ch, CURLOPT_HTTPHEADER, array(

'x-credential-username: smsplus',

'Content-Type: application/json',

'authorization: ' . $authorization,

'date: ' . $dateHeader

));

$response = curl_exec($ch);

$httpCode = curl_getinfo($ch, CURLINFO_HTTP_CODE);

$error = curl_error($ch);

curl_close($ch);

if ($error) {

echo "cURL Error: " . $error . "\n";

} else {

echo "Status Code: " . $httpCode . "\n";

echo "Response: " . $response . "\n";

// Parse JSON response

$jsonResponse = json_decode($response, true);

print_r($jsonResponse);

}

?>#!/usr/bin/perl

use strict;

use warnings;

use LWP::UserAgent;

use HTTP::Request;

use JSON;

use POSIX qw(strftime);

my $url = "https://test.payu.in/info/linkAndPay/get_emi_checkout_details";

# Generate date header in RFC 1123 format

my $date_header = strftime("%a, %d %b %Y %H:%M:%S GMT", gmtime());

# HMAC authorization header (replace with your actual signature)

my $authorization = 'hmac username="x0i6r2", algorithm="sha512", headers="date", signature="0e0ebc518c085d8ff49058b7c232bfe2e8779e9e9cafd34a4cdf1c11114035eea75b0e404a9b9e152757dbcc4926f78b6f18ba7f6643e2bf687a65942d3bde38"';

my $payload = {

amount => 2000000,

userCredentials => "aaa:bbb",

phone => "9560012582",

bankCode => undef,

payuToken => undef

};

my $json_payload = encode_json($payload);

my $ua = LWP::UserAgent->new;

$ua->timeout(30);

my $req = HTTP::Request->new('POST', $url);

$req->header('x-credential-username' => 'smsplus');

$req->header('Content-Type' => 'application/json');

$req->header('authorization' => $authorization);

$req->header('date' => $date_header);

$req->content($json_payload);

my $response = $ua->request($req);

if ($response->is_success) {

print "Status Code: " . $response->code . "\n";

print "Response: " . $response->decoded_content . "\n";

my $json_response = decode_json($response->decoded_content);

use Data::Dumper;

print Dumper($json_response);

} else {

print "Error: " . $response->status_line . "\n";

print "Response: " . $response->decoded_content . "\n";

}Sample response

{

"bnpl": {

"all": [

{

"Lazypay": {

"status": 1,

"kfsLink": https://www.somekfsLink.com, // only if applicable

"eligible": true,

"customerLinked": true,

“PayuToken”: “Token12345”

}

}

]

}

}Step 2: Initiate the payment

You can initiate the payment using the _payment API along with the following additional parameters as in Merchant Hosted Checkout Integration for BNPL. For complete list of parameters and "Try It" experience on API Reference, refer to Collect Payment API - S2S Link and Pay.

Notes:

- The txn_s2s_flow parameter must be passed with the value 4 for OneClick checkout flow.

- User credentials is a request parameter in the payment request which will be the unique identifier for each user that will have to be passed by the merchant and will be used to identify each unique user. It can be string with the following format. abc:xyz (data type: string), abc corresponds to the merchant key and xyz corresponds to the user identifier. For example, BmzSVc: userid

<PaymentAPIEnvironment />

Request parameters

Reference: For Try It experience, refer to Collect Payments API - BNPL under API Reference.

| Parameter | Description | Example |

|---|---|---|

key |

|

JPg***r |

txnid |

|

ypl938459435 |

amount |

|

10.00 |

productinfo |

|

iPhone |

firstname |

|

Ashish |

email |

|

|

phone |

|

|

pg |

String It defines the payment category using the Merchant Hosted Checkout integration. For a BNPL payment, "BNPL" must be specified in the pg parameter. |

BNPL |

bankcode |

|

LAZYPAY |

furl |

|

|

surl |

|

|

txn_s2s_flow |

|

4 |

LinkAndPayFlowType |

|

1 |

LinkAndPayFlowDetails |

|

abc:xyz |

storecard_token_type |

|

1 |

storecard_token |

|

123456 |

user_credentials |

String` Unique user credential mapped against each user, to be passed by the merchant.. |

|

hash |

|

|

address1 |

|

|

address2 |

|

|

city |

|

|

state |

|

|

country |

|

|

zipcode |

|

|

udf1 |

|

|

udf2 |

|

|

udf3 |

|

|

udf4 |

|

|

udf5 |

|

<HashingRequestParameters />

Sample request

curl --request POST \

--url https://test.payu.in/_payment \

--header 'accept: application/json' \

--header 'content-type: application/x-www-form-urlencoded' \

--data key=JPM7Fg \

--data pg=BNPL \

--data txn_s2s_flow=4 \

--data LinkAndPayFlowType=1 \

--data LinkAndPayFlowDetails=1 \

--data txnid=951bccfde0ac54f75612 \

--data amount=2 \

--data productinfo=Product Info \

--data firstname=Ashish \

--data [email protected] \

--data phone=9123412345 \

--data surl=https://apiplayground-response.herokuapp.com/ \

--data furl=https://apiplayground-response.herokuapp.com/ \

--data hash=02647d079d45737aede205a5bf0060ffcf32b5104facebaf901b479b958d80a0e0e88c9edd4f5c9a0576c7bc1688cce15957759029a0e58f5699b8a696c98d10 \

--data user_credentials=abc:xyzimport requests

url = "https://test.payu.in/_payment"

headers = {

"accept": "application/json",

"content-type": "application/x-www-form-urlencoded"

}

data = {

"key": "JPM7Fg",

"pg": "BNPL",

"txn_s2s_flow": "4",

"LinkAndPayFlowType": "1",

"LinkAndPayFlowDetails": "1",

"txnid": "951bccfde0ac54f75612",

"amount": "2",

"productinfo": "Product Info",

"firstname": "Ashish",

"email": "[email protected]",

"phone": "9123412345",

"surl": "https://apiplayground-response.herokuapp.com/",

"furl": "https://apiplayground-response.herokuapp.com/",

"hash": "02647d079d45737aede205a5bf0060ffcf32b5104facebaf901b479b958d80a0e0e88c9edd4f5c9a0576c7bc1688cce15957759029a0e58f5699b8a696c98d10",

"user_credentials": "abc:xyz"

}

response = requests.post(url, headers=headers, data=data)

print("Status Code:", response.status_code)

print("Response:", response.text)import java.io.IOException;

import java.net.URI;

import java.net.URLEncoder;

import java.net.http.HttpClient;

import java.net.http.HttpRequest;

import java.net.http.HttpResponse;

import java.nio.charset.StandardCharsets;

import java.util.HashMap;

import java.util.Map;

import java.util.stream.Collectors;

public class PayUBNPLLinkAndPay {

public static void main(String[] args) throws IOException, InterruptedException {

String url = "https://test.payu.in/_payment";

Map<String, String> params = new HashMap<>();

params.put("key", "JPM7Fg");

params.put("pg", "BNPL");

params.put("txn_s2s_flow", "4");

params.put("LinkAndPayFlowType", "1");

params.put("LinkAndPayFlowDetails", "1");

params.put("txnid", "951bccfde0ac54f75612");

params.put("amount", "2");

params.put("productinfo", "Product Info");

params.put("firstname", "Ashish");

params.put("email", "[email protected]");

params.put("phone", "9123412345");

params.put("surl", "https://apiplayground-response.herokuapp.com/");

params.put("furl", "https://apiplayground-response.herokuapp.com/");

params.put("hash", "02647d079d45737aede205a5bf0060ffcf32b5104facebaf901b479b958d80a0e0e88c9edd4f5c9a0576c7bc1688cce15957759029a0e58f5699b8a696c98d10");

params.put("user_credentials", "abc:xyz");

String formData = params.entrySet().stream()

.map(e -> URLEncoder.encode(e.getKey(), StandardCharsets.UTF_8) + "="

+ URLEncoder.encode(e.getValue(), StandardCharsets.UTF_8))

.collect(Collectors.joining("&"));

HttpClient client = HttpClient.newHttpClient();

HttpRequest request = HttpRequest.newBuilder()

.uri(URI.create(url))

.header("accept", "application/json")

.header("content-type", "application/x-www-form-urlencoded")

.POST(HttpRequest.BodyPublishers.ofString(formData))

.build();

HttpResponse<String> response = client.send(request, HttpResponse.BodyHandlers.ofString());

System.out.println("Status Code: " + response.statusCode());

System.out.println("Response: " + response.body());

}

}<?php

$url = "https://test.payu.in/_payment";

$data = array(

'key' => 'JPM7Fg',

'pg' => 'BNPL',

'txn_s2s_flow' => '4',

'LinkAndPayFlowType' => '1',

'LinkAndPayFlowDetails' => '1',

'txnid' => '951bccfde0ac54f75612',

'amount' => '2',

'productinfo' => 'Product Info',

'firstname' => 'Ashish',

'email' => '[email protected]',

'phone' => '9123412345',

'surl' => 'https://apiplayground-response.herokuapp.com/',

'furl' => 'https://apiplayground-response.herokuapp.com/',

'hash' => '02647d079d45737aede205a5bf0060ffcf32b5104facebaf901b479b958d80a0e0e88c9edd4f5c9a0576c7bc1688cce15957759029a0e58f5699b8a696c98d10',

'user_credentials' => 'abc:xyz'

);

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL, $url);

curl_setopt($ch, CURLOPT_POST, true);

curl_setopt($ch, CURLOPT_POSTFIELDS, http_build_query($data));

curl_setopt($ch, CURLOPT_RETURNTRANSFER, true);

curl_setopt($ch, CURLOPT_HTTPHEADER, array(

'accept: application/json',

'content-type: application/x-www-form-urlencoded'

));

$response = curl_exec($ch);

$httpCode = curl_getinfo($ch, CURLINFO_HTTP_CODE);

curl_close($ch);

echo "Status Code: " . $httpCode . "\n";

echo "Response: " . $response . "\n";

$jsonResponse = json_decode($response, true);

print_r($jsonResponse);

?>#!/usr/bin/perl

use strict;

use warnings;

use LWP::UserAgent;

use HTTP::Request::Common;

my $url = "https://test.payu.in/_payment";

my %data = (

key => 'JPM7Fg',

pg => 'BNPL',

txn_s2s_flow => '4',

LinkAndPayFlowType => '1',

LinkAndPayFlowDetails => '1',

txnid => '951bccfde0ac54f75612',

amount => '2',

productinfo => 'Product Info',

firstname => 'Ashish',

email => '[email protected]',

phone => '9123412345',

surl => 'https://apiplayground-response.herokuapp.com/',

furl => 'https://apiplayground-response.herokuapp.com/',

hash => '02647d079d45737aede205a5bf0060ffcf32b5104facebaf901b479b958d80a0e0e88c9edd4f5c9a0576c7bc1688cce15957759029a0e58f5699b8a696c98d10',

user_credentials => 'abc:xyz'

);

my $ua = LWP::UserAgent->new;

$ua->timeout(30);

my $response = $ua->post($url,

Content_Type => 'application/x-www-form-urlencoded',

Content => \%data

);

if ($response->is_success) {

print "Status Code: " . $response->code . "\n";

print "Response: " . $response->decoded_content . "\n";

} else {

print "Error: " . $response->status_line . "\n";

print "Response: " . $response->decoded_content . "\n";

}Step 3: Check the response from PayU

Sample response

Notes:There will be different scenarios and the response according to different scenarios:

- Repeat User Flow: If the customer’s account is linked and auto-debit is success:

- Repeat User Flow: If the customer’s account is linked and auto debit fails (eg. Customer not eligible, Failed at Payment Option’s end)

- First Time User Flow: If customer is eligible, but is not linked: This is the registration flow, where a first-time user is paying on a merchant with the specific payment option

Success scenario

- Repeat User Flow: Auto-debit Successful

This is the case where Customer’s account is liked & Auto debit is also successful

{

"metaData": {

"message": "No Error",

"referenceId": "748e033af87f1bb7b6aefd405bec9473",

"statusCode": "E000",

"txnId": "951bccfde0ac54f75612",

"unmappedStatus": "success",

"submitOtp": {

"status": "success"

}

},

"result": {

"link_and_pay": {

"customerLinked": "true",

"payuToken": "token12345"

},

"mihpayid": "18828133385",

"mode": "BNPL",

"status": "success",

"key": "smsplus",

"txnid": "951bccfde0ac54f75612",

"amount": "2.00",

"addedon": "2023-12-27 18:13:41",

"productinfo": "Product Info",

"firstname": "Ashish",

"lastname": "",

"address1": "",

"address2": "",

"city": "",

"state": "",

"country": "",

"zipcode": "",

"email": "[email protected]",

"phone": "9123412345",

"udf1": "",

"udf2": "",

"udf3": "",

"udf4": "",

"udf5": "",

"udf6": "",

"udf7": "",

"udf8": "",

"udf9": "",

"udf10": "",

"card_token": "",

"card_no": "",

"field0": "",

"field1": "9582567614",

"field2": "EMI1014338639070843702",

"field3": "Transaction is successful",

"field4": "bnpl",

"field5": "VFhOMzk2MjA3ODY2",

"field6": "TXN396207866",

"field7": "PAYMENT_SUCCESSFUL",

"field8": "SUCCESS",

"field9": "Transaction is successful",

"payment_source": "payuPureS2S",

"PG_TYPE": "BNPL-PG",

"error": "E000",

"error_Message": "No Error",

"net_amount_debit": "2.07",

"discount": "0.00",

"offer_key": "",

"offer_availed": "",

"additionalCharges": "0.07",

"unmappedstatus": "captured",

"hash": "3a7742e5d9284e4f43d349bf1a5ff04353a099920ced98330fab15728841b6c772f00f83163c491d8954ead0c9a1dee7af94d67ddc539ff6cb2d0246baed8148",

"bank_ref_no": "TXN396207866",

"bank_ref_num": "TXN396207866",

"bankcode": "LAZYPAY",

"surl": "https://admin.payu.in/test_response",

"curl": "https://admin.payu.in/test_response",

"furl": "https://admin.payu.in/test_response"

}

}

Failure scenario

- Repeat User Flow: Auto-debit Failed

{

"metaData": {

"message": "The customer is not eligible for this transaction",

"referenceId": "423fe9bfebdb2f92b8ae95a125aff397",

"statusCode": "E2401",

"txnId": "4223974b64f88ab4e3a1",

"txnStatus": "failed",

"unmappedStatus": "failure"

},

"result": {

"link_and_pay": {

"customerLinked": "true",

"payuToken": "token12345"

}

}

}- Failed at Payment option’s end

{

"metaData": {

"message": "Transaction Failed at bank end.",

"referenceId": "ea68a970115a9d87c6ece8d0218e6c2a",

"statusCode": "E308",

"txnId": "54d2d883f8e4a3fff6ba",

"txnStatus": "failed",

"unmappedStatus": "failure"

},

"result": {

"link_and_pay": {

"customerLinked": "true",

"payuToken": "token12345" // can be null or "" <empty string>

}

}

}Handling response

Notes:To request OTP on a page, you can utilize the URLs in the response itself. There are two URLs to use:

- otpPostUrl (Merchant Hosted OTP page)

- acsTemplate (PayU Hosted OTP page) which acts as a fallback

If you are getting a URL in otpPostUrl, use otpPostUrl, otherwise, you can use acsTemplate, which acts as a fallback. In this scenario, use PayU (or WebView or Checkout) OTP page as this is a fallback case. Hence, for cases where the above response is not successful, it could either be Failed or Pending. In the Pending state, you can send a fallback URL (as above) which can be shown to the customer.

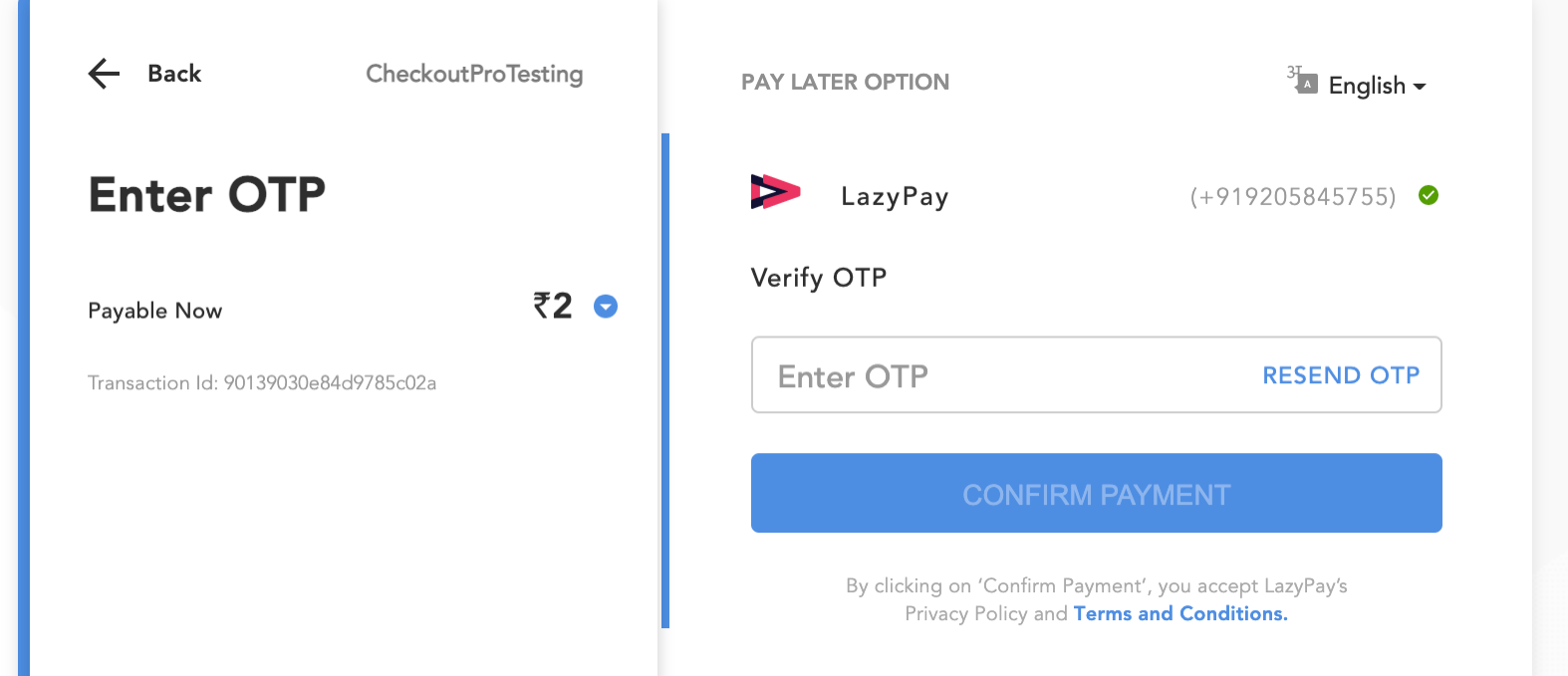

Step 4: Submit the OTP (for First time Flow only)

You can submit the OTP using any of the following methods:

- Capture the OTP natively on your interface

- Use fallback option to redirect to Payu page to capture OTP

Capture the OTP natively on your interface

After you have collected the OTP from the customer, the reference ID can be found in the Collect Payment API (_payment) response. Submit the OTP that is entered by the customer is submitted along with the reference ID using the **Submit OTP **API. For more information, refer to Submit OTP API.

Capture the OTP after redirection to Payu page

The redirect URL would be shared as part of the payment response in acsTemplate using which customer can be redirected to Payu page:

<html> <body> <form name="payment_post" id="payment_post" action="https://test.payu.in/ _payment_options?mihpayid=1983a7cf520b567155ed95ca181e37e3&resendEligibilityRes =3594c73b18f7ca9e8146f0bb3d0bd8429e5a20c2f61d778bfd0fb4b0d430ebd21a8d8ff20e7775 8c903a71fe22d39d1494127034ed7d505237cb6f7bf80cc3107a02cbd22217c19f6662efac8e8f8 3dca902470a981bdd0a0c03847d546f41ad8f3066b2ccc8a359e03032953f36112d0e551ec19ba7 1954dfe788d18a28ac7609ba53bd77548cffb81882347fc8b97315509afdf8a0894443cf91e0b1f de84594bee6fc9d39da884f3021eb2224618e2c7f115a02057051987220ec7864ecc44a012417e4 880b187ee1f12363a25a4bec62d8322eb1b185195a714124b5de94309a6dce42ef441464d3462e7 809670c" method="post"></form> <script type='text/javascript'> window.onload=function(){ document.forms['payment_post'].submit(); } </script> </body> </html>On opening the above HTML, you will get a PayU checkout OTP page similar to the following screenshot:

From here, the steps are as in PayU Hosted (non-seamless) or Merchant Hosted or Server-to-Server (seamless) transactions.

Handling incorrect OTP submission

Incorrect OTP Submission is allowed 3 times in total (1 + 2 retries), post which the transaction fails. Scenarios are described as follows:

Note: If the customer enters the incorrect OTP or OTP has expired, you need to resend the OTP to the customer using the Resend OTP API and then submit using the Submit OTP API. For more information, refer to Collect Payments with BNPL-Merchant Hosted Checkout

- Case 1: With 1st Incorrect retry OTP attempt

{

"metaData": {

"message": "Unauthorized",

"referenceId": "ac2155676982514fd2e3199e83a9c9ec",

"txnId": "ad5a54b6af3e52ab24d6",

"unmappedStatus": "in progress",

"submitOtp": {

"status": "in progress",

"retryAttemptCount": "2"

}

},

"result": null

}

- Case 2: With 2nd Incorrect retry OTP attempt

{

"metaData": {

"message": "Unauthorized",

"referenceId": "ac2155676982514fd2e3199e83a9c9ec",

"txnId": "ad5a54b6af3e52ab24d6",

"unmappedStatus": "in progress",

"submitOtp": {

"status": "in progress",

"retryAttemptCount": "1"

}

},

"result": null

}

Note: The driving factor here is retryAttemptCount. In case 1, retryAttemptCount was 2, whereas it is 1 in case 2.

Reference: If your customer fails to authorize the payment due to incorrect OTP submission or the OTP was submitted after OTP had expired, they can request another OTP based on the number of retry attempts remaining using the Resend OTP API. For more information, refer to Resend OTP API.

Step 5: Verify the payment

Upon receiving the response, we recommend performing a reconciliation step to validate all transaction details.

You can verify your payments using either of the following methods:

Updated 26 days ago