UPI Intent with S2S Integration

This section includes the workflow and steps to integrate UPI Intent with Server-to-Server integration.

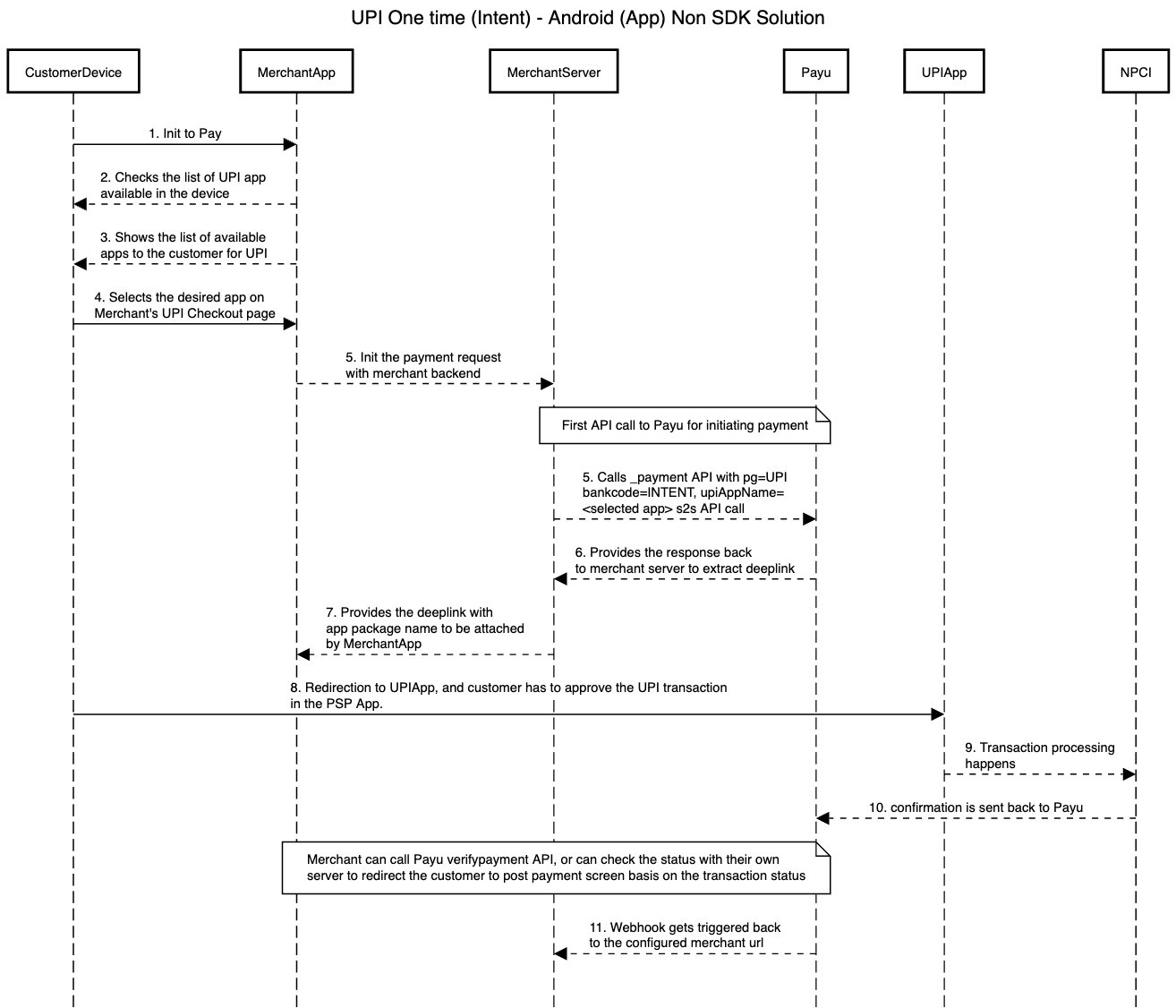

Smart Intent Flow

Workflow

Steps to integrate

Update Manifest File [One-Time]

Add package ids in your apps manifest file to allow your application to access apps installed on the customer's device. This is required for Android 11 and above.

<queries>

<package android:name="in.amazon.mShop.android.shopping"/>

<package android:name="com.upi.axispay"/>

<package android:name="com.axis.mobile"/>

<package android:name="com.fisglobal.bandhanupi.app"/>

<package android:name="com.bankofbaroda.upi"/>

<package android:name="in.org.npci.upiapp"/>

<package android:name="com.canarabank.mobility"/>

<package android:name="com.citiuat"/>

<package android:name="com.dbs.in.digitalbank"/>

<package android:name="com.olive.dcb.upi"/>

<package android:name="com.finopaytech.bpayfino"/>

<package android:name="com.freecharge.android"/>

<package android:name="com.google.android.apps.nbu.paisa.user"/>

<package android:name="com.snapwork.hdfc"/>

<package android:name="com.mgs.hsbcupi"/>

<package android:name="com.csam.icici.bank.imobile"/>

<package android:name="com.icicibank.pockets"/>

<package android:name="com.euronet.iobupi"/>

<package android:name="com.mgs.induspsp"/>

<package android:name="com.fss.jnkpsp"/>

<package android:name="com.jio.myjio"/>

<package android:name="com.mycompany.kvb"/>

<package android:name="com.kvb.mobilebanking"/>

<package android:name="com.lcode.smartz"/>

<package android:name="com.msf.kbank.mobile"/>

<package android:name="com.upi.federalbank.org.lotza"/>

<package android:name="com.infrasofttech.mahaupi"/>

<package android:name="com.mipay.in.wallet"/>

<package android:name="com.myairtelapp"/>

<package android:name="com.mobikwik_new"/>

<package android:name="com.onymy.paybee.prod"/>

<package android:name="net.one97.paytm"/>

<package android:name="com.phonepe.app"/>

<package android:name="com.Version1"/>

<package android:name="com.samsung.android.spay"/>

<package android:name="com.sbi.upi"/>

<package android:name="com.SIBMobile"/>

<package android:name="com.truecaller"/>

<package android:name="com.infrasoft.uboi"/>

<package android:name="com.lcode.ucoupi"/>

<package android:name="com.YesBank"/>

<package android:name="com.dreamplug.androidapp"/>

<package android:name="money.bullet"/>

</queries>Step 1: Fetch the List of UPI and Smart Intent Supported Apps

List the specific apps for app/webview/m-web, (In IOS, UPI collect can still be used).

Step 2: Get Intent URI

Use the _payment API to get Intent URI and transaction details for the UPI app selected by the customer. For more information, refer to UPI Intent with S2S Integration.

Request Parameters

| Parameter | Description | Example |

|---|---|---|

keymandatory | String Merchant key provided by PayU during onboarding. | JPg****f |

txnidmandatory | String The transaction ID is a reference number for a specific order that is generated by the merchant. | ypl938459435 |

amountmandatory | String The payment amount for the transaction. | 10.00 |

productinfomandatory | String A brief description of the product. | iPhone |

firstnamemandatory | String The first name of the customer. | Ashish |

lastnamemandatory | String The last name of the customer. | Kumar |

emailmandatory | String The email address of the customer. | [email protected] |

phonemandatory | String The phone number of the customer. | |

address1optional but recommended for higher approval rate | String The first line of the billing address. H.No- 17, Block C, Kalyan Bldg, Khardilkar Road, Mumbai Note: This information is helpful when it comes to issues related to fraud detection and chargebacks. Hence, it is must to provide the correct information. | 34 Saikripa-Estate, Tilak Nagar |

address2optional but recommended for higher approval rate | String The second line of the billing address. | |

cityoptional but recommended for higher approval rate | String The city where your customer resides as part of the billing address. | Mumbai |

stateoptional but recommended for higher approval rate | String The state where your customer resides as part of the billing address. | Maharashtra |

countryoptional but recommended for higher approval rate | String The country where your customer resides. | India |

zipcodemandatory | String Billing address zip code is mandatory for the cardless EMI option. Character Limit-20 | 400004 |

pgmandatory for seamless/s2s flow | String It defines the payment category and post UPI. | UPI |

bankcodemandatory for seamless/s2s flow | String Each payment option is identified with a unique bank code at PayU. For UPI Autopay, post UPI. | UPI |

surlmandatory | String The success URL, which is the page PayU will redirect to if the transaction is successful. | |

furlmandatory | String The Failure URL, which is the page PayU will redirect to if the transaction is failed. | |

vpa conditional | String Customer's VPA handle. Mandatory for UPI Collect flow. | customer@upi |

si mandatory | String Signifies successful consent taken from the user. Must be 1 for subscription setup. | 1 |

si_details mandatory | JSON String JSON object containing mandate details (billingAmount, billingCurrency, billingCycle, etc.). Refer to si_details JSON Object below. | See si_details accordion |

txn_s2s_flow conditional | Integer Parameter to enable S2S flow. Must be 4 for Legacy Decoupled flow (UPI Intent). | 4 |

s2s_client_ip conditional | String Source IP of the customer. Required for UPI Intent flow. | 10.200.12.12 |

s2s_device_info conditional | String Customer agent's device information. Required for UPI Intent flow. | Mozilla/5.0 (Windows NT 10.0; Win64; x64) |

udf1mandatory if AD bank request this detail | String This parameter must contain the Buyer's PAN and date of birth in the following format (separated by two pipe characters): Buyer's PAN\|\|Buyer'sDOB | AAAPZ1234C\|\|22/08/1972 |

udf3mandatory if AD bank request this detail | String This parameter must contain the invoice ID of the transaction (generated by the merchant) and merchant name in the following format (separated by two pipe characters): Invoice ID\|\|MerchantName | INV-123_1231\|\|MerchantName |

buyer_type_business optional in case of B2B transaction for cross-border payments | Binary To be sent as "1" in case the buyer is a business. In case of individual buyers, it can be skipped. Default is "0". Note: This will be included in hash if posted (covered in next section | 1 |

Sample Request

curl --location 'https://test.payu.in/_payment' \

--header 'Content-Type: application/x-www-form-urlencoded' \

--data-urlencode 'key=PRiQvJ' \

--data-urlencode 'txnid=my_order_991' \

--data-urlencode 'amount=1' \

--data-urlencode 'productinfo=my_order_991' \

--data-urlencode 'email=' \

--data-urlencode 'phone=9368252248' \

--data-urlencode 'txn_s2s_flow=4' \

--data-urlencode 'hash=||||||ABCDE1234F||1990-01-01||INV123456||||||' \

--data-urlencode 'surl=https://test.payu.in/admin/test_response' \

--data-urlencode 'furl=https://test.payu.in/admin/test_response' \

--data-urlencode 'udf1=buyer'\''s DOB' \

--data-urlencode 'udf2=' \

--data-urlencode 'udf3=buyer'\''s PAN' \

--data-urlencode 'udf4=' \

--data-urlencode 'udf5=invoice number' \

--data-urlencode 's2s_client_ip=10.200.12.12' \

--data-urlencode 's2s_device_info=Mozilla/5.0 (Windows NT 10.0; Win64; x64) PayU-API-Test/1.0' \

--data-urlencode 'firstname=' \

--data-urlencode 'lastname=kr' \

--data-urlencode 'address1=308,third floor' \

--data-urlencode 'address2=testing' \

--data-urlencode 'city=Gurugram' \

--data-urlencode 'state=UP' \

--data-urlencode 'country=India' \

--data-urlencode 'zipcode=122018' \

--data-urlencode 'pg=UPI' \

--data-urlencode 'bankcode=INTENT' \

--data-urlencode 'upiAppName=gpay/phonepe/paytm/qr/amazonpay' \

--data-urlencode 'udf_params={"udf7":"asdf","udf8":"12"}' \

--data-urlencode 'buyer_type_business=1'Step 3: Retrieve Deeplink(uriIntentData) from the response,

If metaData.unmappedStatus = pending, then get the result.intentURIData and add the prefix upi://pay?to make it to create a fully qualified deeplink to trigger the UPI App.

{

"metaData": {

"message": null,

"referenceId": "c99a6455b3e0dc5cd7167ab8c8cc10d2fa153cb509e3f64c6cd0ed9c5b64a8c9",

"statusCode": null,

"txnId": "my_order_26075",

"txnStatus": "pending",

"unmappedStatus": "pending"

},

"result": {

"paymentId": "403993715535965242",

"merchantName": "Sudhanshu",

"merchantVpa": "payutest@hdfcbank",

"amount": "1.00",

"intentURIData": "pa=payutest@hdfcbank&pn=Kumar&tr=403993715535965242&tid=PPPL403993715535965242080126220900&am=1.00&cu=INR&tn=UPIIntent",

"acsTemplate": "PGh0bWw+PGJvZHk+PGZvcm0gbmFtZT0icGF5bWVudF9wb3N0IiBpZD0icGF5bWVudF9wb3N0IiBhY3Rpb249Imh0dHBzOi8vdGVzdC5wYXl1LmluL2M5OWE2NDU1YjNlMGRjNWNkNzE2N2FiOGM4Y2MxMGQyYzgzYTk5NmFhNDhiYTk4MmZjMGQ4MTI1MGY1ODgxZjMvaW50ZW50U2VhbWxlc3NIYW5kbGVyLnBocCIgbWV0aG9kPSJwb3N0Ij48aW5wdXQgdHlwZT0iaGlkZGVuIiBuYW1lPSJ0b2tlbiIgdmFsdWU9IjhERDNFRUFFLUI5NTktQzY1RS03MDczLTYzQTNGQUUxMjZGRiI+PGlucHV0IHR5cGU9ImhpZGRlbiIgbmFtZT0iYW1vdW50IiB2YWx1ZT0iMS4wMCI+PGlucHV0IHR5cGU9ImhpZGRlbiIgbmFtZT0ibWlocGF5aWQiIHZhbHVlPSJjOTlhNjQ1NWIzZTBkYzVjZDcxNjdhYjhjOGNjMTBkMmZhMTUzY2I1MDllM2Y2NGM2Y2QwZWQ5YzViNjRhOGM5Ij48aW5wdXQgdHlwZT0iaGlkZGVuIiBuYW1lPSJkaXNhYmxlSW50ZW50U2VhbWxlc3NGYWlsdXJlIiB2YWx1ZT0iMCI+PGlucHV0IHR5cGU9ImhpZGRlbiIgbmFtZT0icGF5ZWVWcGEiIHZhbHVlPSJwYXl1dGVzdEBoZGZjYmFuayI+PGlucHV0IHR5cGU9ImhpZGRlbiIgbmFtZT0icGF5ZWVOYW1lIiB2YWx1ZT0iU3VkaGFuc2h1Ij48aW5wdXQgdHlwZT0iaGlkZGVuIiBuYW1lPSJhZGRpdGlvbmFsQ2hhcmdlcyIgdmFsdWU9IjAiPjxpbnB1dCB0eXBlPSJoaWRkZW4iIG5hbWU9InRyYW5zYWN0aW9uRmVlIiB2YWx1ZT0iMS4wMCI+PC9mb3JtPjxzY3JpcHQgdHlwZT0ndGV4dC9qYXZhc2NyaXB0Jz4KICAgICAgICAgICAgICAgICAgICAgICAgICAgIHdpbmRvdy5vbmxvYWQ9ZnVuY3Rpb24oKXsKICAgICAgICAgICAgICAgICAgICAgICAgICAgICAgICBkb2N1bWVudC5mb3Jtc1sncGF5bWVudF9wb3N0J10uc3VibWl0KCk7CiAgICAgICAgICAgICAgICAgICAgICAgICAgICB9CiAgICAgICAgICAgICAgICAgICAgICAgIDwvc2NyaXB0PjwvYm9keT48L2h0bWw+",

"otpPostUrl": "https://test.payu.in/ResponseHandler.php"

}

}Step 4: Set the Package Name

Set the packageName as per the app selected by the customer on your checkout page. and start the activity.

fun makePayment(packageName: String,mActivity: Activity,intentUri:String) {

val i = Intent()

i.setPackage(packageName)

i.action = Intent.ACTION_VIEW

i.data = Uri.parse("upi://pay" + intentUri)

if (null != mActivity && !mActivity.isFinishing() && !mActivity.isDestroyed()) {

mActivity.startActivityForResult(i, 101)

}

}Step 5: Handle the response

Once the user completes the payment the UPI app will be closed, and then handle the response onActivityResult.

override fun onActivityResult(requestCode: Int, resultCode: Int, data: Intent?) {

super.onActivityResult(requestCode, resultCode, data)

if (requestCode == 101) {

data?.getStringExtra("Status")?.let { Log.d("result", it) }

data?.getStringExtra("response")?.let { Log.d("response", it) }

//get Status

//if Status == Success

// Call Verify Payemnt//

}

}Step 6: Verify the payment

Upon receiving the response, PayU recommends you performing a reconciliation step to validate all transaction details.

You can verify your payments using either of the following methods:

Configure the webhooks to monitor the status of payments.

Webhooks enable a server to communicate with another server by sending an HTTP callback or message.

These callbacks are triggered by specific events or instances and operate at the server-to-server (S2S) level.

Know how to manage Webhooks for Payments.

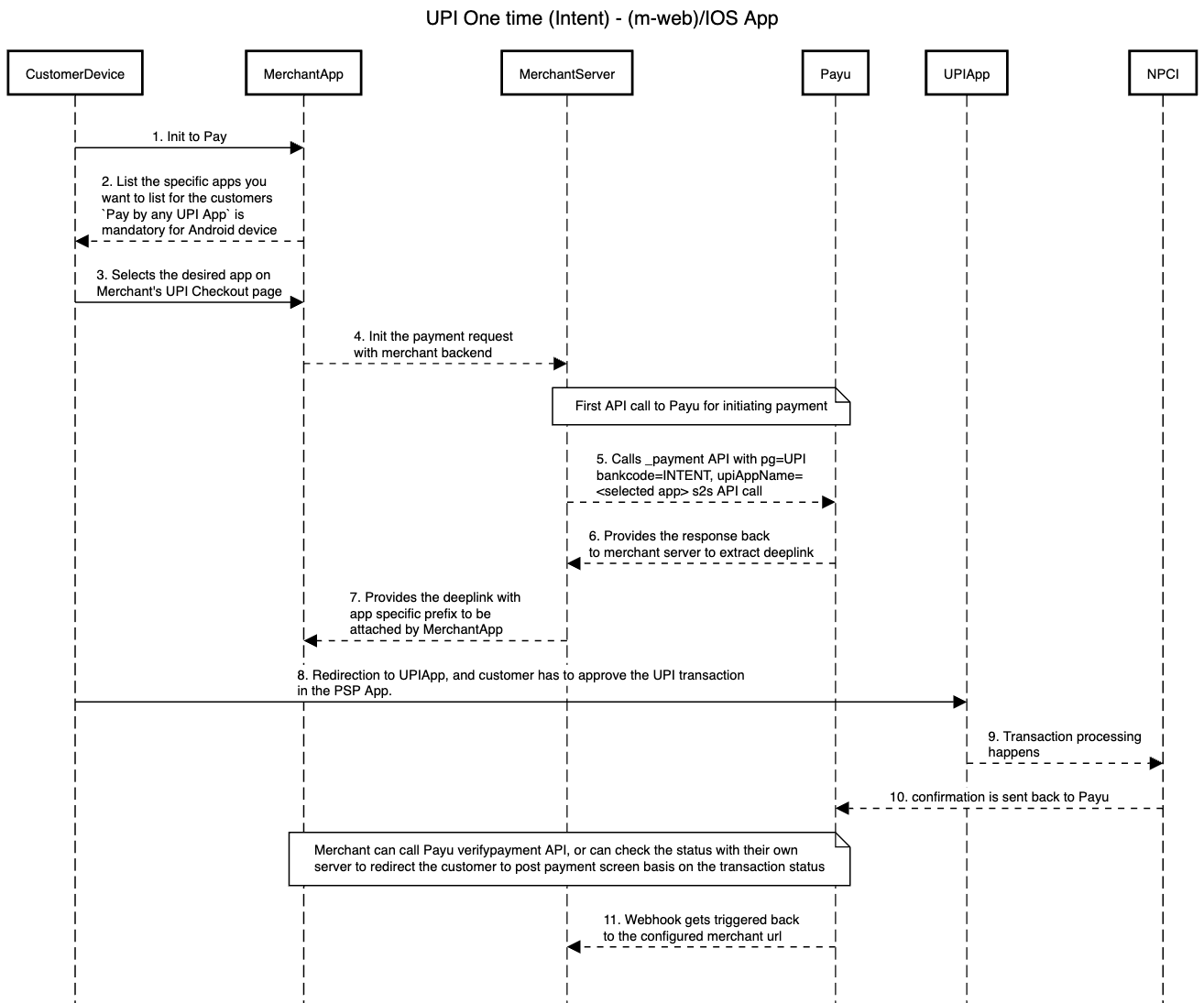

Specific Intent Flow

Notes: Specific Intent flow works with m-web, Webview, Android or iOS apps. As per NPCI mandate, Pay by any UPI App option must be shown by all the merchants in their app on all Android devices (app/m-web/webview), Use the generic deeplink, without specific

packageNameto trigger the Pay by any UPI app.

Workflow

Steps to Integrate

Step 1: Fetch the List of UPI and Smart Intent Supported Apps

You need to get the list of UPI and smart intent supported applications installed in the device.

private fun getSmartIntentUPIApps(context: Context?):ArrayList<HashMap<String,String>>?{

val upiApps = ArrayList<HashMap<String, String>>()

if (context == null)

return null

val intent = Intent()

intent.data = Uri.parse("upi://pay")

val activityList = context.packageManager.queryIntentActivities(intent, PackageManager.MATCH_DEFAULT_ONLY)

for (resolveInfo in activityList){

var packageInfo: PackageInfo? = null

try {

packageInfo = context.packageManager

.getPackageInfo(resolveInfo.activityInfo.packageName, 0)

val name =

context.packageManager.getApplicationLabel(packageInfo.applicationInfo) as String

val appInfo = HashMap<String, String?>()

appInfo["bankName"] = name ?: "NA"

appInfo["packageName"] = packageInfo.packageName

upiApps.add(appInfo)

} catch (e: PackageManager.NameNotFoundException) {

e.printStackTrace()

return upiApps

}

}

return UPI apps

}

/* to get icon of psp app*/

fun getUpiAppBitmap(context: Context?, packageName: String): Bitmap? {

var upiAppBitmap: Bitmap? = null

if (context == null)

return upiAppBitmap

upiAppBitmap = context.packageManager.getApplicationIcon(packageName).toBitmap()

return upiAppBitmap

}

Step 2: Get Intent URI

Use the _payment API to get Intent URI and transaction details for the UPI app selected by the customer. For more information, refer to UPI Intent with S2S Integration.

Request Parameters

| Parameter | Description | Example |

|---|---|---|

keymandatory | String Merchant key provided by PayU during onboarding. | JPg****f |

txnidmandatory | String The transaction ID is a reference number for a specific order that is generated by the merchant. | ypl938459435 |

amountmandatory | String The payment amount for the transaction. | 10.00 |

productinfomandatory | String A brief description of the product. | iPhone |

firstnamemandatory | String The first name of the customer. | Ashish |

lastnamemandatory | String The last name of the customer. | Kumar |

emailmandatory | String The email address of the customer. | [email protected] |

phonemandatory | String The phone number of the customer. | |

address1optional but recommended for higher approval rate | String The first line of the billing address. H.No- 17, Block C, Kalyan Bldg, Khardilkar Road, Mumbai Note: This information is helpful when it comes to issues related to fraud detection and chargebacks. Hence, it is must to provide the correct information. | 34 Saikripa-Estate, Tilak Nagar |

address2optional but recommended for higher approval rate | String The second line of the billing address. | |

cityoptional but recommended for higher approval rate | String The city where your customer resides as part of the billing address. | Mumbai |

stateoptional but recommended for higher approval rate | String The state where your customer resides as part of the billing address. | Maharashtra |

countryoptional but recommended for higher approval rate | String The country where your customer resides. | India |

zipcodemandatory | String Billing address zip code is mandatory for the cardless EMI option. Character Limit-20 | 400004 |

pgmandatory for seamless/s2s flow | String It defines the payment category and post UPI. | UPI |

bankcodemandatory for seamless/s2s flow | String Each payment option is identified with a unique bank code at PayU. For UPI Autopay, post UPI. | UPI |

surlmandatory | String The success URL, which is the page PayU will redirect to if the transaction is successful. | |

furlmandatory | String The Failure URL, which is the page PayU will redirect to if the transaction is failed. | |

vpa conditional | String Customer's VPA handle. Mandatory for UPI Collect flow. | customer@upi |

si mandatory | String Signifies successful consent taken from the user. Must be 1 for subscription setup. | 1 |

si_details mandatory | JSON String JSON object containing mandate details (billingAmount, billingCurrency, billingCycle, etc.). Refer to si_details JSON Object below. | See si_details accordion |

txn_s2s_flow conditional | Integer Parameter to enable S2S flow. Must be 4 for Legacy Decoupled flow (UPI Intent). | 4 |

s2s_client_ip conditional | String Source IP of the customer. Required for UPI Intent flow. | 10.200.12.12 |

s2s_device_info conditional | String Customer agent's device information. Required for UPI Intent flow. | Mozilla/5.0 (Windows NT 10.0; Win64; x64) |

udf1mandatory if AD bank request this detail | String This parameter must contain the Buyer's PAN and date of birth in the following format (separated by two pipe characters): Buyer's PAN\|\|Buyer'sDOB | AAAPZ1234C\|\|22/08/1972 |

udf3mandatory if AD bank request this detail | String This parameter must contain the invoice ID of the transaction (generated by the merchant) and merchant name in the following format (separated by two pipe characters): Invoice ID\|\|MerchantName | INV-123_1231\|\|MerchantName |

buyer_type_business optional in case of B2B transaction for cross-border payments | Binary To be sent as "1" in case the buyer is a business. In case of individual buyers, it can be skipped. Default is "0". Note: This will be included in hash if posted (covered in next section | 1 |

Sample Request

curl --location 'https://test.payu.in/_payment' \

--header 'Content-Type: application/x-www-form-urlencoded' \

--data-urlencode 'key=PRiQvJ' \

--data-urlencode 'txnid=my_order_991' \

--data-urlencode 'amount=1' \

--data-urlencode 'productinfo=my_order_991' \

--data-urlencode 'email=' \

--data-urlencode 'phone=9368252248' \

--data-urlencode 'txn_s2s_flow=4' \

--data-urlencode 'hash=||||||ABCDE1234F||1990-01-01||INV123456||||||' \

--data-urlencode 'surl=https://test.payu.in/admin/test_response' \

--data-urlencode 'furl=https://test.payu.in/admin/test_response' \

--data-urlencode 'udf1=buyer'\''s DOB' \

--data-urlencode 'udf2=' \

--data-urlencode 'udf3=buyer'\''s PAN' \

--data-urlencode 'udf4=' \

--data-urlencode 'udf5=invoice number' \

--data-urlencode 's2s_client_ip=10.200.12.12' \

--data-urlencode 's2s_device_info=Mozilla/5.0 (Windows NT 10.0; Win64; x64) PayU-API-Test/1.0' \

--data-urlencode 'firstname=' \

--data-urlencode 'lastname=kr' \

--data-urlencode 'address1=308,third floor' \

--data-urlencode 'address2=testing' \

--data-urlencode 'city=Gurugram' \

--data-urlencode 'state=UP' \

--data-urlencode 'country=India' \

--data-urlencode 'zipcode=122018' \

--data-urlencode 'pg=UPI' \

--data-urlencode 'bankcode=INTENT' \

--data-urlencode 'upiAppName=gpay/phonepe/paytm/qr/amazonpay' \

--data-urlencode 'udf_params={"udf7":"asdf","udf8":"12"}' \

--data-urlencode 'buyer_type_business=1'Step 3: Retrieve Deeplink(uriIntentData) from the response,

If metaData.unmappedStatus = pending, then get the result.intentURIData and add the prefix upi://pay?to make it to create a fully qualified deeplink to trigger the UPI App.

{

"metaData": {

"message": null,

"referenceId": "c99a6455b3e0dc5cd7167ab8c8cc10d2fa153cb509e3f64c6cd0ed9c5b64a8c9",

"statusCode": null,

"txnId": "my_order_26075",

"txnStatus": "pending",

"unmappedStatus": "pending"

},

"result": {

"paymentId": "403993715535965242",

"merchantName": "Sudhanshu",

"merchantVpa": "payutest@hdfcbank",

"amount": "1.00",

"intentURIData": "pa=payutest@hdfcbank&pn=Kumar&tr=403993715535965242&tid=PPPL403993715535965242080126220900&am=1.00&cu=INR&tn=UPIIntent",

"acsTemplate": "PGh0bWw+PGJvZHk+PGZvcm0gbmFtZT0icGF5bWVudF9wb3N0IiBpZD0icGF5bWVudF9wb3N0IiBhY3Rpb249Imh0dHBzOi8vdGVzdC5wYXl1LmluL2M5OWE2NDU1YjNlMGRjNWNkNzE2N2FiOGM4Y2MxMGQyYzgzYTk5NmFhNDhiYTk4MmZjMGQ4MTI1MGY1ODgxZjMvaW50ZW50U2VhbWxlc3NIYW5kbGVyLnBocCIgbWV0aG9kPSJwb3N0Ij48aW5wdXQgdHlwZT0iaGlkZGVuIiBuYW1lPSJ0b2tlbiIgdmFsdWU9IjhERDNFRUFFLUI5NTktQzY1RS03MDczLTYzQTNGQUUxMjZGRiI+PGlucHV0IHR5cGU9ImhpZGRlbiIgbmFtZT0iYW1vdW50IiB2YWx1ZT0iMS4wMCI+PGlucHV0IHR5cGU9ImhpZGRlbiIgbmFtZT0ibWlocGF5aWQiIHZhbHVlPSJjOTlhNjQ1NWIzZTBkYzVjZDcxNjdhYjhjOGNjMTBkMmZhMTUzY2I1MDllM2Y2NGM2Y2QwZWQ5YzViNjRhOGM5Ij48aW5wdXQgdHlwZT0iaGlkZGVuIiBuYW1lPSJkaXNhYmxlSW50ZW50U2VhbWxlc3NGYWlsdXJlIiB2YWx1ZT0iMCI+PGlucHV0IHR5cGU9ImhpZGRlbiIgbmFtZT0icGF5ZWVWcGEiIHZhbHVlPSJwYXl1dGVzdEBoZGZjYmFuayI+PGlucHV0IHR5cGU9ImhpZGRlbiIgbmFtZT0icGF5ZWVOYW1lIiB2YWx1ZT0iU3VkaGFuc2h1Ij48aW5wdXQgdHlwZT0iaGlkZGVuIiBuYW1lPSJhZGRpdGlvbmFsQ2hhcmdlcyIgdmFsdWU9IjAiPjxpbnB1dCB0eXBlPSJoaWRkZW4iIG5hbWU9InRyYW5zYWN0aW9uRmVlIiB2YWx1ZT0iMS4wMCI+PC9mb3JtPjxzY3JpcHQgdHlwZT0ndGV4dC9qYXZhc2NyaXB0Jz4KICAgICAgICAgICAgICAgICAgICAgICAgICAgIHdpbmRvdy5vbmxvYWQ9ZnVuY3Rpb24oKXsKICAgICAgICAgICAgICAgICAgICAgICAgICAgICAgICBkb2N1bWVudC5mb3Jtc1sncGF5bWVudF9wb3N0J10uc3VibWl0KCk7CiAgICAgICAgICAgICAgICAgICAgICAgICAgICB9CiAgICAgICAgICAgICAgICAgICAgICAgIDwvc2NyaXB0PjwvYm9keT48L2h0bWw+",

"otpPostUrl": "https://test.payu.in/ResponseHandler.php"

}

}Step 4: Add the prefix

Add the prefix as per the Android/IOS to it to create a fully qualified deeplink to trigger the UPI App.

Android Specific Intent prefix

androidPrefix="intent://pay?"

intentUriData="pa=myntra.payu@axisbank&pn=NIMIT%20BHATIA&tr=26156866365&tid=PPPL2615686636525112512114769254fab&am=10.00&cu=INR&tn=UPIIntent"

suffix = "#Intent;scheme=upi;package=<package name>;"

suffixForFallback="S.browser_fallback_url=<base64decoded result.acsTemplate can be used to redirect to Payu for UPI fallback>;end"

//use androidPrefix+intentUriData+suffix+suffixForFallback to trigger the App in specific deeplink integrationIOS Specific Intent prefix (Limited availability)

phonepe = phonepe://upi/pay?

paytm = paytm://upi/pay?

googlepay = gpay://upi/pay?

bhim = bhim://upi/pay?

credpay = credpay://upi/pay?Step 5: Verify the payment

Upon receiving the response, PayU recommends you performing a reconciliation step to validate all transaction details.

You can verify your payments using either of the following methods:

Configure the webhooks to monitor the status of payments.

Webhooks enable a server to communicate with another server by sending an HTTP callback or message.

These callbacks are triggered by specific events or instances and operate at the server-to-server (S2S) level.

Know how to manage Webhooks for Payments.

Updated 22 days ago