iOS Native OTP Assist SDK

The OTP Assist SDK provides a complete authentication flow for card transactions. It offers to capture OTP in the merchant app without any redirection to the bank's 3Dsecure/ACS page. This means that there's one less point of failure in the checkout process and a faster completion rate for transactions. The OTP Assist SDK will auto-read and submit OTP on behalf of the user.

Features

The Native OTP Assist SDK gives you the following key capabilities:

- Read OTP on the merchant app without redirecting to the bank page, for eligible bins.

- If the bin is not eligible, then it will redirect to the bank's 3d-secure/ACS page.

- Support for Android native SMS permission, as well as Google Consent API.

Step 1. SDK Integration

The iOS Native OTP Assist SDK integration involves the following steps:

Step 1: Include the SDK

The Native OTP SDK is offered via CocoaPods. To add the SDK to your app project, include the SDK framework in your podfile.

// make sure to add below-mentioned line to use dynamic frameworksuse_frameworks! // Add this to include our SDK pod 'PayUIndia-NativeOtpAssist'

Install dependency using pod installcommand in terminalNext, add the following imports in the class where you need to initiate a payment:

import PayUNativeOtpAssist#import <PayUNativeOtpAssist/PayUNativeOtpAssist.h>

Compatibilty

- Min SDK Version: 21

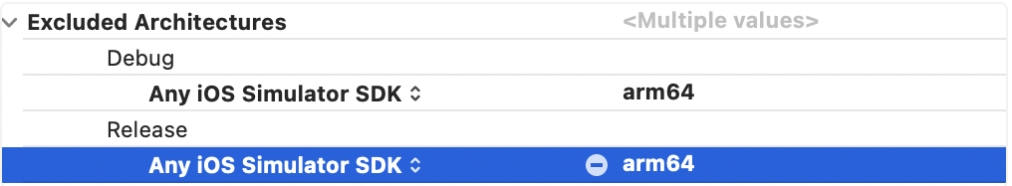

Note: Configure Excluded Architectures to arm64 in the Build Settings of your project to run in Simulator.

In order to receive all the crashes related to our SDKs, add the below-mentioned line to your AppDelegate's didFinishLaunchingWithOptions.

CrashReporter

In order to receive all the crashes related to our SDKs, add the below-mentioned line to your AppDelegate's didFinishLaunchingWithOptions.

PayUOtpAssist.start()[PayUOtpAssist start];Swift Package Manager integration

You can integrate PayUIndia-NativeOtpAssist with your app or SDK with the following methods:

- Using Xcode: Navigate to the File > Add Package menu and install the following package: https://github.com/payu-intrepos/PayUNativeOtpAssist-iOS

- Using Package.Swift: Add the following line in the Package.swift dependencies:

.package(name: "PayUIndia-NativeOtpAssist", url: "https://github.com/payu-intrepos/PayUNativeOtpAssist-iOS", from: "2.0.0")

Step 2: Generate payment hash

For detailed information on hash generation, refer to Hash Generation.

CalloutEvery transaction (payment or non-payment) needs a hash by the merchant before sending the transaction details to PayU. This is required for PayU to validate the authenticity of the transaction. This should be done on your server.

Create postData

To initiate a payment, your app will need to send transactional information to the Checkout Pro SDK. To pass this information, build a payment parameter object similar to the following code snippet:

Note: TransactionId can't have a special character and not more than 25 characters.

let paymentParam = PayUPaymentParam(key: <#T##String#>,

transactionId: <#T##String#>,

amount: <#T##String#>,

productInfo: <#T##String#>,

firstName: <#T##String#>,

email: <#T##String#>,

phone: <#T##String#>,

surl: <#T##String#>,

furl: <#T##String#>,

environment: <#T##Environment#> /*.production or .test*/)

paymentParam.hashes = PayUHashes()

paymentParam.hashes?.paymentHash = <#T##SHA512 HashString#>

let ccdc = CCDC()

ccdc.cardNumber = <#T##String#>

ccdc.expiryYear = <#T##String#>

ccdc.expiryMonth = <#T##String#>

ccdc.cvv = <#T##String#>

ccdc.txnS2SFlow = <#T##String#> //"4" for transactions on native otp assist

ccdc.nameOnCard = <#T##String#>

ccdc.shouldSaveCard = <#T##String#>

paymentParam.paymentOption = ccdc

paymentParam.userCredential = <#T##String#> // For saving and fetching user's saved cardPayUPaymentParam *paymentParam = [[PayUPaymentParam alloc] initWithKey:<#(NSString * _Nonnull)#>

transactionId:<#(NSString * _Nonnull)#>

amount:<#(NSString * _Nonnull)#>

productInfo:<#(NSString * _Nonnull)#>

firstName:<#(NSString * _Nonnull)#>

email:<#(NSString * _Nonnull)#>

phone:<#(NSString * _Nonnull)#>

surl:<#(NSString * _Nonnull)#>

furl:<#(NSString * _Nonnull)#>

environment:<#(enum Environment)#> /*EnvironmentProduction or EnvironmentTest*/];

paymentParam.hashes = [PayUHashes new];

paymentParam.hashes.paymentHash = <#T##SHA512 HashString#>;

CCDC *ccdc = [CCDC new];

ccdc.cardNumber = <#T##String#>;

ccdc.expiryYear = <#T##String#>;

ccdc.expiryMonth = <#T##String#>;

ccdc.cvv = <#T##String#>;

ccdc.txnS2SFlow = <#T##String#>; //"4" for transactions on native otp assist

ccdc.nameOnCard = <#T##String#>;

ccdc.shouldSaveCard = <#T##String#>;

paymentParam.paymentOption = ccdc;

paymentParam.userCredential = <#(NSString)#>; // For saving and fetching use saved

NoteUse Core SDK library to generate payment post data.

Step 3: Initiate payment

Initialize the Native OTP Assist SDK by providing the PayUOtpAssistConfig object having thepostdata and reference to the PayUOtpAssistCallback to listen to the SDK events.

[PayUCheckoutPro openOn:self paymentParam:paymentParam config:<#(PayUOtpAssistConfig * _Nullable)#> delegate:self];PayUOtpAssist.open(

parentVC: self,

paymentParam: paymentParam,

config: <#T##PayUOtpAssistConfig?#>,

delegate: self

)Note: Initiate payment must be on the Main thread.

Callbacks

The list of the callback function provided by PayUOtpAssistCallback class:

-

fun onPaymentSuccess(merchantResponse: String?, payUResponse: String?)– Called when payment succeeds. merchantResponse: -

fun onPaymentFailure(merchantResponse: String?, payUResponse: String?)– Called when a payment fails. -

fun onError(errorCode: String?, errorMessage: String?)- Called when we got some error where,errorCode: Error CodeerrorMessage: Error Description

-

fun shouldHandleFallback(payUAcsRequest: PayUAcsRequest):Boolean – It's an optional callback, override when you want to handle the Bank page redirection flow. You just need to change the return value to false. You can also open CustomBrowser in fallback scenarios. The following code snippet is used to open the CustomBrowser. For more information on using CustomBrowser, refer to iOS CustomBrowser SDK.

fun shouldHandleFallback(payUAcsRequest: PayUAcsRequest) : Boolean {

val customBrowserConfig = CustomBrowserConfig(merchantKey, txnId)

//Set the issuerUrl and issuerPostData to open in WebView for otp assist redirection to bank page

if (!payUAcsRequest?.issuerUrl.isNullOrEmpty() && !payUAcsRequest?.issuerPostData.isNullOrEmpty()) {

customBrowserConfig.postURL = payUAcsRequest?.issuerUrl

customBrowserConfig.payuPostData = payUAcsRequest?.issuerPostData

}else if (!payUAcsRequest?.acsTemplate.isNullOrEmpty()){

customBrowserConfig.htmlData = payUAcsRequest?.acsTemplate

}else {

//Set the first url to open in WebView

customBrowserConfig.postURL = url

customBrowserConfig.payuPostData = payuConfig.data

}

return false

}You will get PayUAcsRequest on shouldHandleFallback() callback. whether you will get issuerUrl and issuerPostData or acsTemplate on PayUAcsRequest acsTemplate is the HTML string that you need to load to the Webview.

| PayUAcsRequest field | Description |

|---|---|

| issuerUrl | It's the Bank/ACS page Url. |

| issuerPostData | You need to load issuerUrl to the Webview along with this issuerPostdata string. Ex: webView.postUrl(issuerUrl, issuerPostData.toByteArray()) |

| acsTemplate | If issuerUrl is empty, you need to load acsTemplate to the Webview. Ex: webView.loadData(acsTemplate, "text/html", "UTF-8"); |

Error codes

| Error Code | Description |

|---|---|

| 1001 | No Internet |

| 1002 | Network timeout, please verify with your server. |

| 1003 | Gateway timeout, please verify with your server. |

| 1004 | The user canceled it, please verify with your server. |

| 1005 | Something went wrong, please verify with your server. |

| 1006 | The bank page timed out, please verify with your server. |

Step 4: Verify the transaction

After you get the response from SDK, make sure to confirm it with the PayU server.

Remember: It is recommended to implement the PayU Webhook or backend verify call from your backend. For more information, refer to Webhooks.

Implementation of Verify Payment API

Since you already have the txnID (Order ID generated at your end) value for such cases, you simply need to execute the verify_payment API with the necessary input parameters. The output would return you the transaction status in the status key and various other parameters also. For more information, refer to the Verify Payment Status API.

Endpoint URL: https://info.payu.in/merchant/postservice.php?form=2

Sample Request

curl --location --request POST '{{Url}}' \

--header 'Content-Type: application/x-www-form-urlencoded' \

--data-urlencode 'key={merchantKey}' \

--data-urlencode 'command=verify_payment' \

--data-urlencode 'hash=c6febddfaaf6986dd8bd982d3769f856ab149e4de92dbad995c8df808ffcfbcb2c227a3fae38b69eb39ad7b6ce4e06e6b12289f70cc500cea5a2cda449c7dcba' \

--data-urlencode 'var1=Txn1234'Step 2. Test the Integration and Go-Live

Test the integration and Go-Live

Test the Integration

After the integration is complete, you must test the integration before you go live and start collecting payment. You can start accepting actual payments from your customers once the test is successful.

You can make test payments using one of the payment methods configured at the Checkout.

Test credentials for supported payment methods

Following are the payment methods supported in PayU Test mode.

Test credentials for Net Banking

Use the following credentials to test the Net Banking integration:

- user name: payu

- password: payu

- OTP: 123456

Test VPA for UPI

You can use either of the following VPAs to test your UPI-related integration:

CalloutThe UPI in-app and UPI intent flow is not available in the Test mode.

Test cards for EMI

You can use the following Debit and Credit cards to test EMI integration.

Test wallets

You can use the following wallets and their corresponding credentials to test wallet integration.

Go-Live Checklist

Ensure these steps before you deploy the integration in a live environment.

Collect Live Payments

After testing the integration end-to-end, once you are confident that the integration is working as expected, you can switch to live mode to start accepting payments from your customers.

Watch Out!Ensure that you are using the production merchant key and salt generated in the live mode.

Checklist 2: Configure environment

Set the value of the environmentto test/production in the payment integration code. This enables the integration to accept live payments.

Checklist 3: Configure your SURL/FURL

PayU recommends you to design, your own SURL and FURL.

Refer the Link to Handle SURL and FURL.

You are not recommended to go live with PayU SURL and FURL.

Checklist 4: Configure Verify Payment

Configure the Verify payment method to fetch the payment status. For more information, refer to Verify Payment API

Checklist 5: Configure Webhook

PayU recommends you to configure Webhooks to receive payment responses on your server. For more information, refer to Webhooks.

Updated 4 months ago