Add a Sub-Account

Adding a sub-account, sub-merchant or child merchant involves the following major steps:

- Step 1: Basic Details

- Step 2: Verify PAN

- Step 3: Business Details

- Step 4: Sub-Account Bank Details

- Step 5: Verifying Authority Details

- Step 6: Additional Documents

Notes:

- There is no mail sent or intimated to sub-merchant when you add a sub-merchant using this procedure.

- PayU will verify the documents submitted in Step 6: Additional Documents and activate the sub-account by two working days. If you encounter any issues, contact your PayU Account Manager or PayU Support.

The following describes the procedure to add a sub-account:

Step 1: Basic details

-

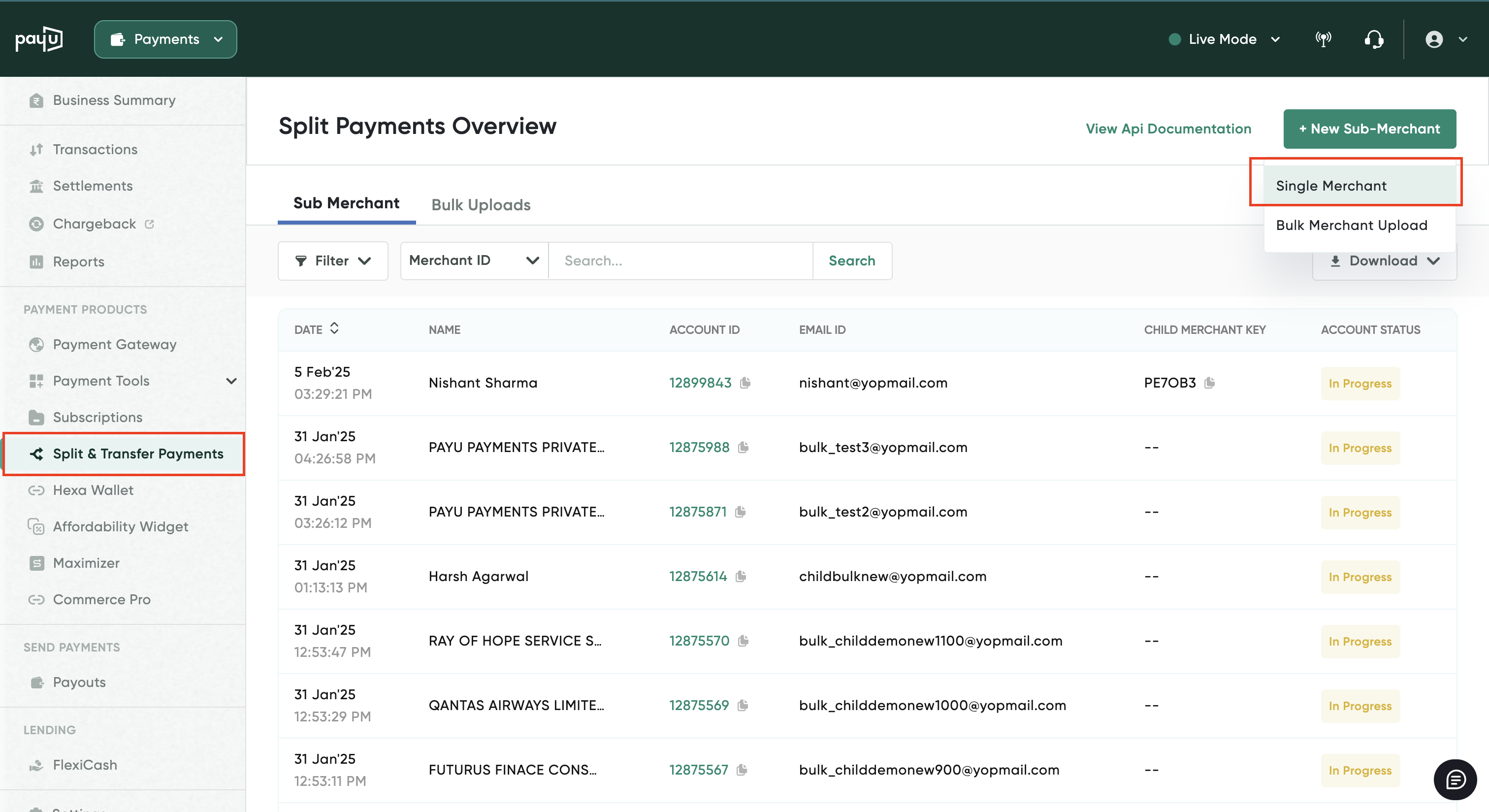

Select Split & Transfer Payments on the menu.

The Split Payments Overview page is displayed.

-

Click New Sub-Merchant at the top-right corner and select Single Merchant.

From the dropdown, select Single Merchant .

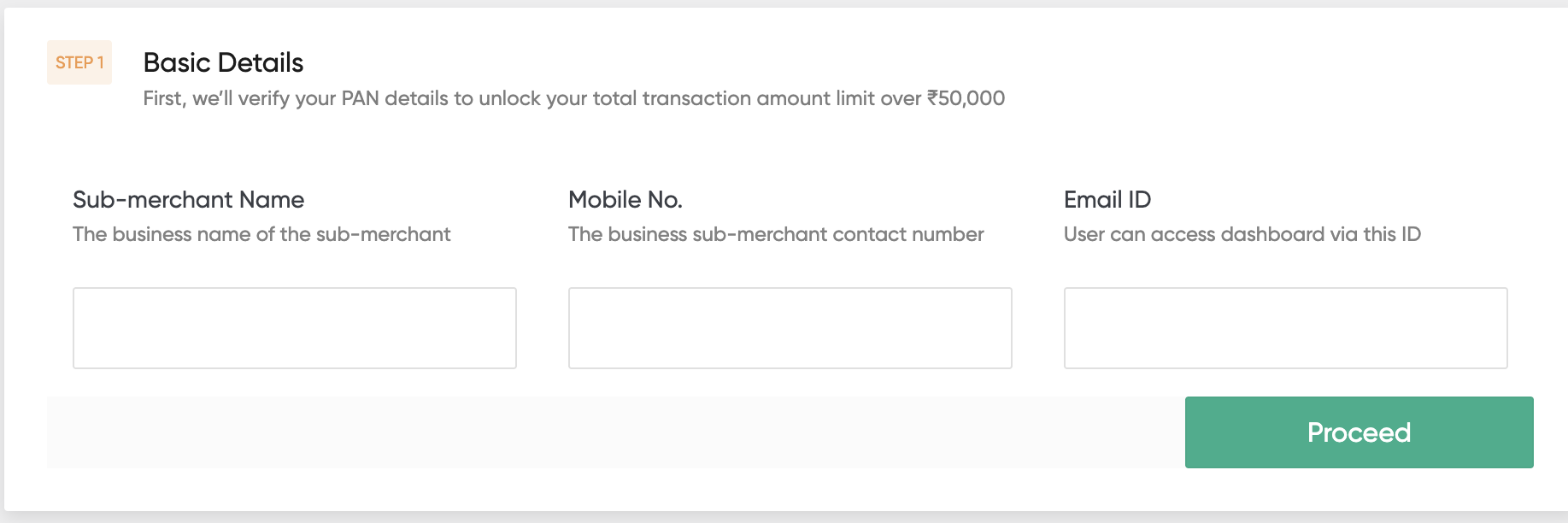

- Enter the details as specified in the following table:

| Field | Description |

|---|---|

| Sub-merchant Name | Enter the business account name in this field. The name entered in the field will be printed in the various reports generated from PayU Dashboard. |

| Mobile No | Enter your 10-digit mobile number in this field. |

| Email ID | Enter your business email ID linked to this Dashboard in this field. |

-

Click Proceed.

The page is refreshed to display the other panes to complete the sub-account details.

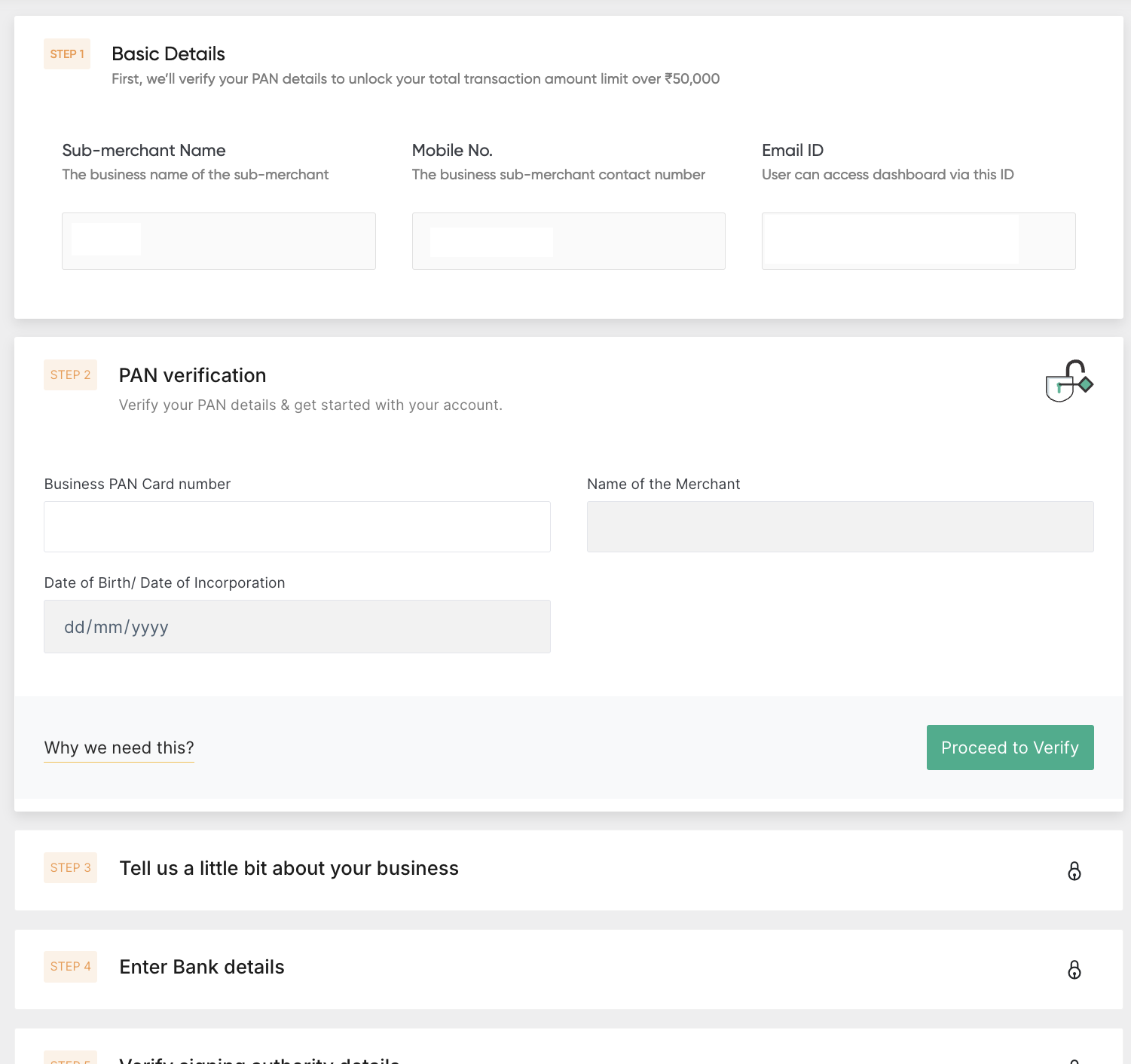

Step 2: PAN verification

-

Enter your business PAN card number in the Business PAN Card Number field. If your business is a sole proprietorship, enter your personal PAN card number.

-

Enter your date of birth or company’s date of incorporation in the Date of Birth/Date of Incorporation field.

-

Click Proceed to Verify.

A pop-up page is displayed to choose the business entity.

-

Select your business entity type from the drop-down and click the Confirm I am<your business name> button. Where <your business name> is substituted with the name you entered in the Business PAN Card Number field at Step 2.

The Tell us a little bit about your business pane is displayed.

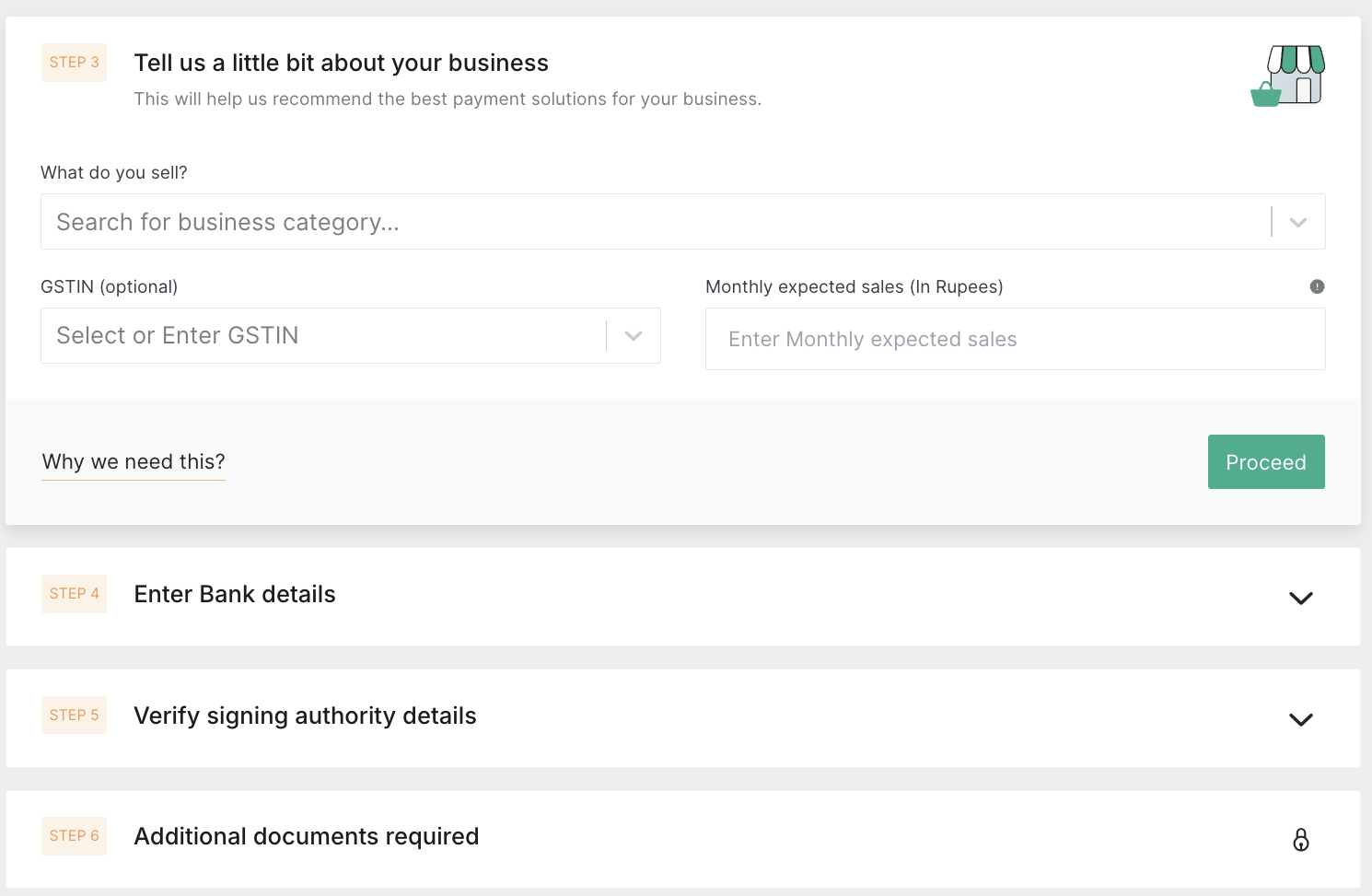

Step 3: Business details

- Enter the details on the Tell us a little bit about your business pane as specified in the following table:

| Field | Description |

|---|---|

| Business Category | Select your business category from this drop-down list. |

| GSTIN | Enter your GSTIN if your business has GSTIN. |

| Monthly expected Sales (in Rupees) | Enter the expected sales from your business per month (in rupees) in this field. |

-

Click Proceed.

The Step 4: Enter Bank Details <your name> pane is displayed.

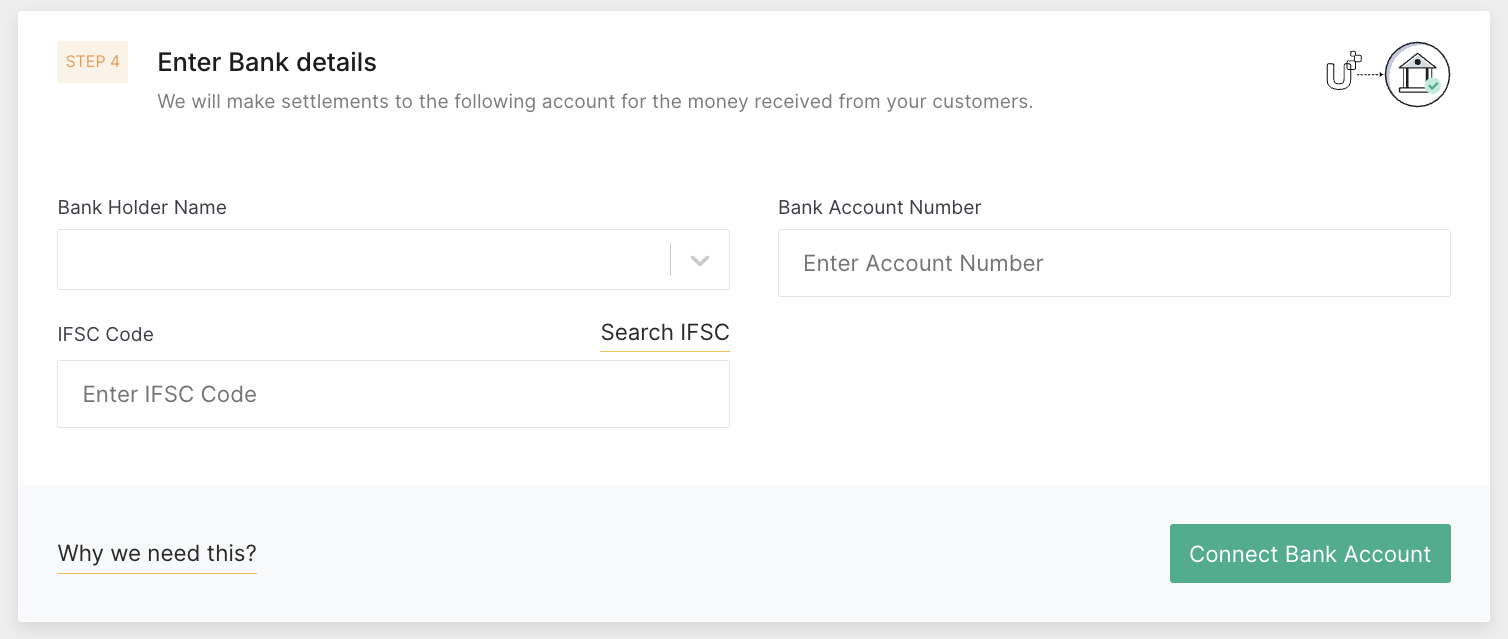

Step 4: Bank details

- Enter the sub-account bank details as described in the following table:

Note: In case you do not have sub-account or child merchant bank details or if you skip the step, follow the steps as described in Step 2: Update bank details of Create Child Merchant API.

| Field | Description |

|---|---|

| Bank Holder Name | Select the name of the beneficiary from the drop-down list. |

| Bank Account Number | Enter the account number of the beneficiary. |

| IFSC Code | Enter the bank branch IFSC code or click the Search IFSC option to search and select the IFSC code. |

-

Click Connect Bank Account.

The Step 5: Verifying Authority Details pane is displayed.

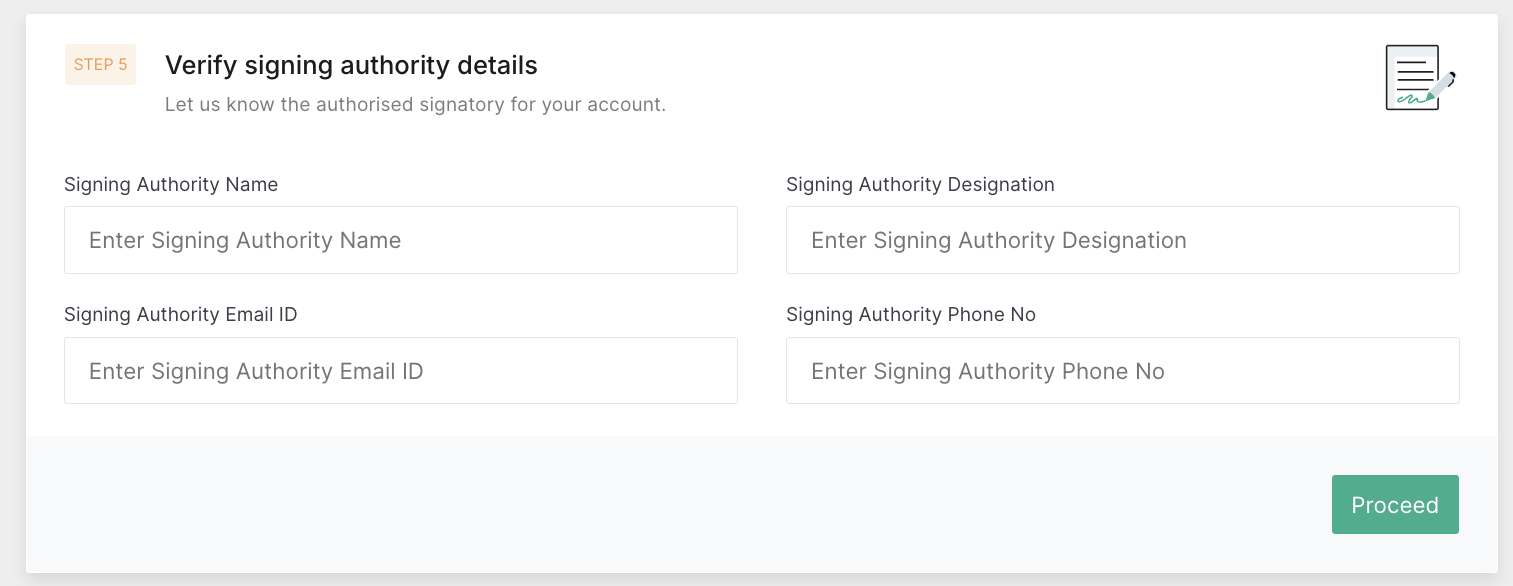

Step 5: Verifying Authority Details

- Enter the signing authority details of your company as described in the following table:

| Field | Description |

|---|---|

| Signing Authority Name | Enter the signing authority name. |

| Signing Authority Designation | Enter the signing authority designation. |

| Signing Authority Email ID | Enter the signing authority email-ID. |

| Signing Authority Phone No | Enter the signing authority phone number. |

- Click Connect Bank Account.

The Step 6: Additional documents required pane is displayed.

Step 6: Additional Documents

Notes:

- Upload signed schedule C document through your parent merchant or Dashboard

- E-Sign Schedule C through OTP, triggered by parent merchant

- If bank account verification fails, then cancelled cheque needs to be uploaded

- Select any of the following options from the Bank Account Proof of drop-down list and upload the proof document using the Upload Document Select a scanned copy or photo of your PAN card:

- Passport

- Bank Passbook

- Canceled Cheque

- Bank Verification Letter

-

Upload the Schedule C document using the Upload Schedule C field. Also, you can ask your sub-merchant to e-sign the schedule C addendum using the Send Email to Child button.

-

Click Submit Documents.

After the sub-account bank details are submitted, the following confirmation message is displayed.

Verification of Docs:PayU will verify the documents and activate the sub-account by two working days. If you encounter any issues, contact your PayU Account Manager or PayU Support.

If the sub-account bank details are not entered, the following page is displayed so that you can share it with your merchant.

Updated 4 months ago